By Ambar Warrick

Investing.com-- Chinese property developer Country Garden Holdings Company Ltd (HK:2007) said on Thursday that its profit for the first half of 2022 is expected to drop substantially amid a severe real estate downturn.

The firm, which is the sixth-largest property developer in China, said its net profit attributable to shareholders for the six months to June 30 is expected between 200 million yuan and 1 billion yuan ($29.5 million and $147.5 million), down from 15 billion yuan a year ago.

Country Garden said in a statement to the Hong Kong Stock Exchange that the decline was largely due to a weakening real estate market in the mainland, which dented the revenue recognized on properties sold.

The firm is making more provisions to prepare for impairments in its property projects. It also flagged continued headwinds from the COVID-19 pandemic, which has spurred a series of strict lockdowns across China this year.

The firm said it will report its interim earnings in the second half of August. Excluding one-off items, such as provisions, Country Garden expects core net profit of 4.5 billion yuan to 5 billion yuan, down from 15.2 billion yuan last year.

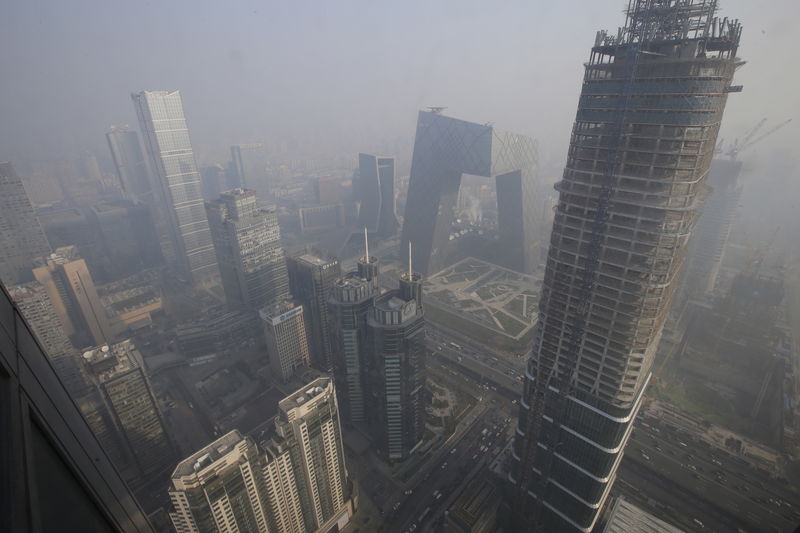

Country Garden’s warning comes amid an ongoing crisis in China’s real estate market, which has wiped out around $90 billion in stocks and bonds so far this year. Investment bank JPMorgan warned that most real estate developers in the mainland are expected to see severe earnings declines, Bloomberg reported this week.

Chinese house prices have crashed this year, with real estate developers facing mortgage boycotts from homeowners refusing to pay for unfinished projects. New home prices sank 0.9% in July from last year, their worst month since late 2015.

While the real estate crisis came to light after a series of defaults by China Evergrande Group (HK:3333) last year, China’s zero-COVID policy, which ground the economy to a halt in 2022, has exacerbated the crisis.

A bulk of China’s relief efforts have been aimed at homeowners, not developers, which has worsened the outlook for real estate firms. The country is reportedly planning on more bond issuances and guarantees to support the sector, but has not released any official word on the matter.

Slowing economic growth in China has also spurred a slew of stimulus measures, including a recent interest rate cut by the People’s Bank of China.