(Bloomberg Opinion) -- Cause and effect. Action, reaction. As China cracks down on shadow finance, private companies and state giants alike are learning that the karmic wheel of money can come to a screeching halt.

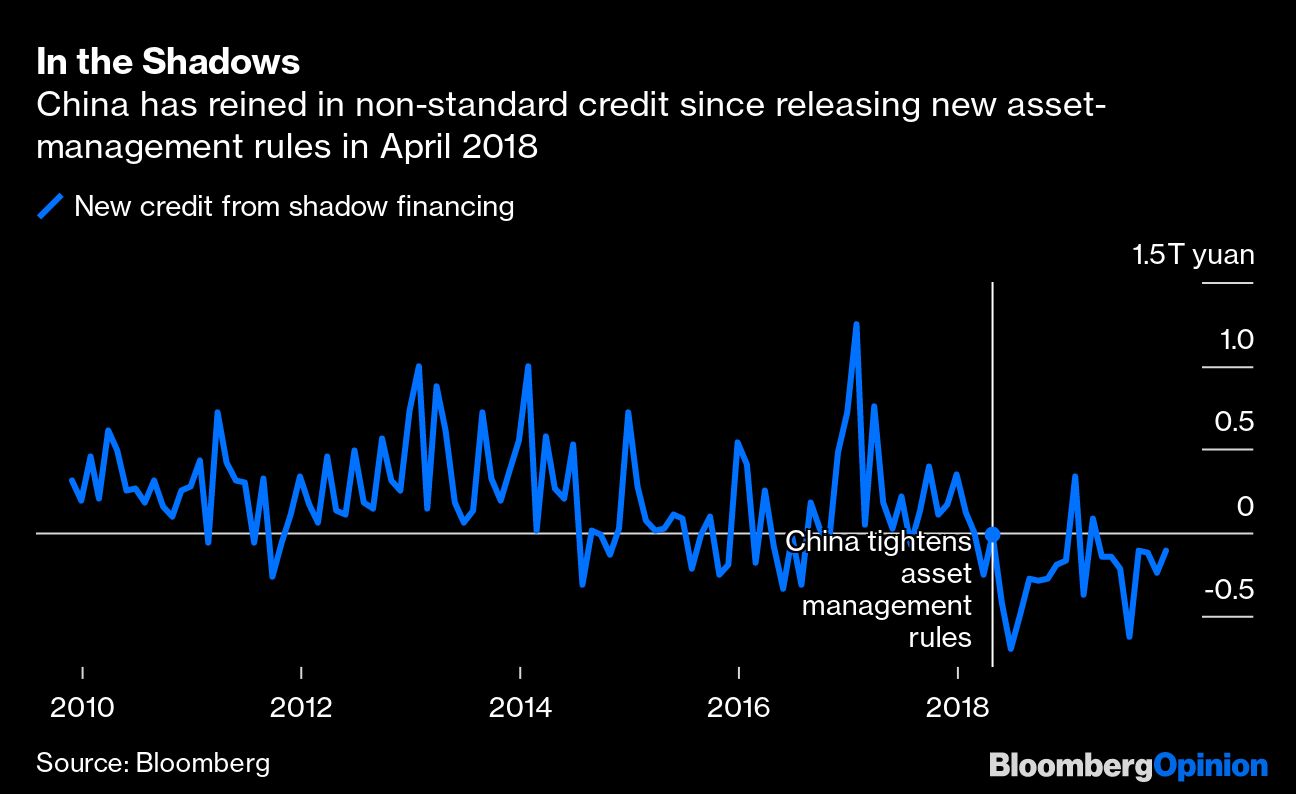

In April 2018, China unveiled far-reaching rules for its financial industry as part of an effort to curb risk. Banks were asked to spin off their wealth-management arms, which had helped funnel credit to an overburdened private sector, and stick to traditional, boring (read: low-yielding) loan books. They were given three years to adopt the new rules, ending in December 2020.

This was a declaration of war on shadow financing. The industry shrank by 1.6 trillion yuan ($229.1 billion) in 2019, after contracting by 2.9 trillion yuan a year earlier.

The policy change has already inflicted some damage. Onshore bond defaults hit a record high for two straight years. In 2019, most of them came from private-sector borrowers struggling to refinance, while state-owned enterprises emerged largely unscathed.

As we enter 2020, however, China’s draconian reforms could start to backfire on the state, too.

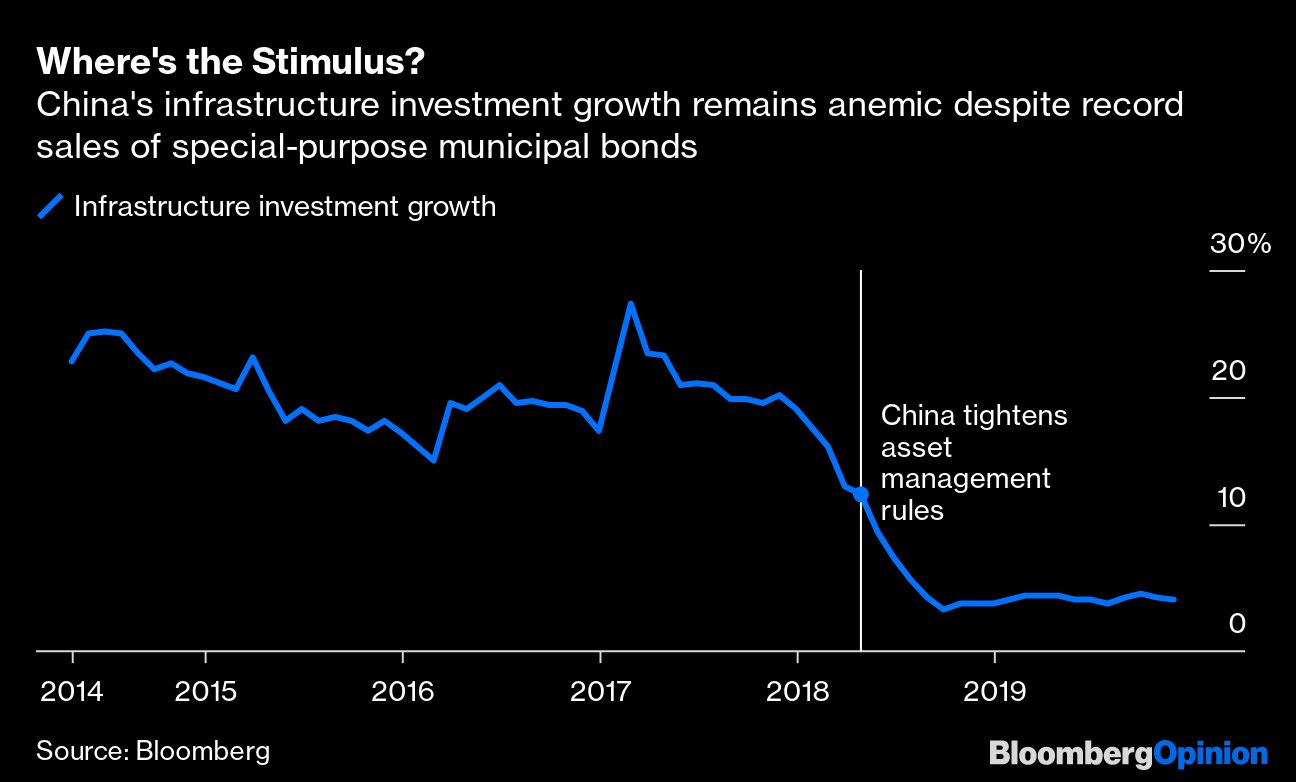

For starters, a shadow-banking crackdown has severely restricted Beijing’s fiscal prowess. To boost infrastructure spending, officials have been allowing local governments to issue special-purpose municipal bonds at a record pace, even bringing forward the quota for 2020. Yet infrastructure spending remains anemic, growing even slower than the overall economy.

Why would this be? Since 2015, Beijing has been relying on public-private partnerships to build roads and railways. But private money has essentially evaporated after the new rules prevented wealth-management products, typically short-term instruments, from investing in longer-term projects. Meanwhile, China’s new municipal bond issues, at roughly 2 trillion yuan a year, can’t meet the nation’s annual infrastructure spending of 17 trillion yuan.

Beyond a few hiccups, faith in China’s public-sector bond issuers remained relatively unshaken in 2019. Every once in a while, a local government financing vehicle would be a few days late in its coupon repayment, but Beijing hasn't allowed these municipally run, off-balance-sheet shell companies to default. Ever.

This may not be such a sure bet in 2020. LGFVs have amassed a huge pile of debt over the past decade: 33 trillion yuan, according to S&P Global Ratings. Of that, only about a quarter is in bonds; the rest comes in the form of bank loans and non-standard credit. In other words, private enterprises aren't the only ones dipping into the shadow-banking well. Impoverished local governments are, too.

Many of the 1,800-plus LGFVs have deep relations with shadow banks, data compiled by Huatai Securities Co. show. In Guizhou province, for example, these entities get 20% of their financing from non-standard sources of credit. In Tongren, a city in the region, that figure is 72%. This should come as no surprise: As providers of public services and infrastructure, LGFVs often struggle to generate enough cash flow, and even state-owned banks are holding back credit from the poorest areas.

As we witnessed in 2018 and 2019, private enterprises have no choice but to default when one of their key funding channels is cut off. Unless China takes a policy U-turn, the same phenomenon may repeat with municipals’ financing vehicles.

By now, the realization that banks prefer state-linked entities has become deeply ingrained in China’s business community. So how do private businesses get cheap credit? By pretending to be affiliated with the government. Already, quite a few “fakes” have blown up in investors’ faces.

China Minsheng Investment Group Corp., for example, repeatedly tested bondholders’ nerves last year. The company has managed to amass 232 billion yuan in debt in just four years, largely thanks to its status as the brainchild of Premier Li Keqiang and its pledge to serve “national strategy as its mission,” according to a 2016 bond prospectus. Yet the company remains privately held.

Or consider Peking University Founder Group, which surprised traders in December with a late bond payment. Investors have long associated the conglomerate — whose business spans finance, real estate and commodity trading — with the Ministry of Education. As a legal tussle unfolds, though, many are starting to question the strength of Founder’s state ties. The company could be one of the biggest corporate defaults in China: It has 23 onshore notes outstanding, with two-thirds, or 24 billion yuan, due over the next year.

Similar soap operas will continue to play out because being a fake state-owned enterprise is the only way to get good credit. And Beijing will have no choice but to step in, or risk its own reputation.

What’s missing in all this is why China’s biggest state-owned banks aren’t filling the void. One explanation is that they have little incentive. These lenders have remained profitable, with the big four earning almost 1 trillion yuan in net profit in the last year. Lending to private businesses requires grunt work, and credit officers simply aren't interested. They’d rather write loans to state giants such as China Mobile Ltd. and go back into hibernation.

Meanwhile, Beijing has tweaked its credit statistics to appear friendlier to private businesses, all while lecturing China Inc. that allowing some defaults will help borrowers kick their debt addictions. While such advice is easy to dole out, it makes for bitter medicine when trouble starts brewing within state-run businesses. So, junk bond traders, rejoice! Those defaults you fear could dwindle in 2020. China’s war on shadow banking can’t last forever.