By Huw Jones

LONDON (Reuters) -Government policies to encourage companies to pay more dividends should make China's stock market more attractive for overseas investors, a senior Chinese regulator said on Thursday.

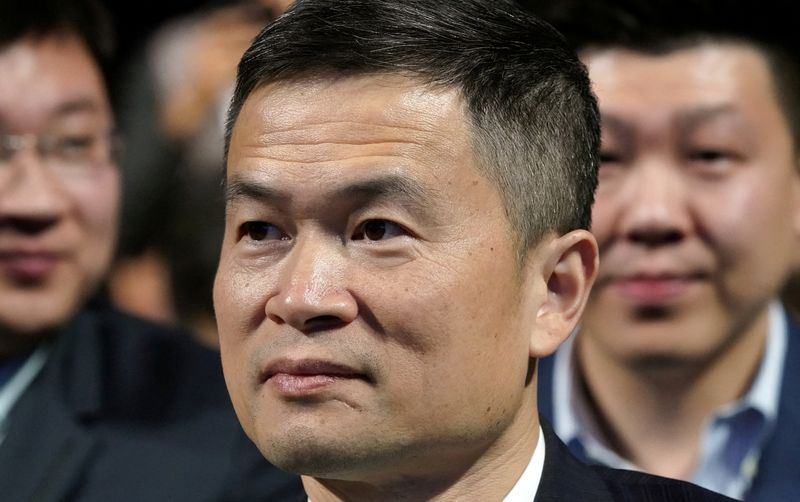

Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said the government set out policies last month to strengthen capital markets, including moves to encourage listed companies to pay more dividends.

"Chinese listed companies traditionally have not paid enough dividends. We are now encouraging them to pay more dividends," Fang told a 'roadshow' in London to lure more overseas investment in Chinese listed companies.

"This should very much enhance investor value of Chinese stocks going forward," Fang told the event hosted by the Shanghai and Shenzhen stock exchanges.

Foreign investor participation in China and the wider Asian region has risen in recent years, said Huiqi Pei of Shenzhen Stock Exchange's international department.

"We are encouraging companies to pay more dividends, to value investor relations, and that is the new style a lot of companies are putting lots of emphasis on," Pei told the event.

Fang said drivers of China's decades-long rapid growth rates, such as investment in infrastructure, real estate and exports, were now "clearly receding".

"I understand this is very much on investors' minds when they consider investment in Chinese assets, particularly stocks," Fang said.

The Chinese government is now focusing on three new drivers - exports to developing countries, increasing domestic consumption from relatively low levels compared with the United States and other advanced economies, and creating manufacturing excellence, Fang said.

Increases in productivity from automation and digitalisation in manufacturing will also ensure a recovery in corporate earnings, Fang added.

"High-quality growth is the number one priority for our government. Capital markets are fundamental to such growth," Fang said.