(Bloomberg) -- China’s central bank injected liquidity into the financial system via open-market operations for the first time since Feb. 17, ending the longest hiatus since December 2018. It also cut interest rates on the loans.

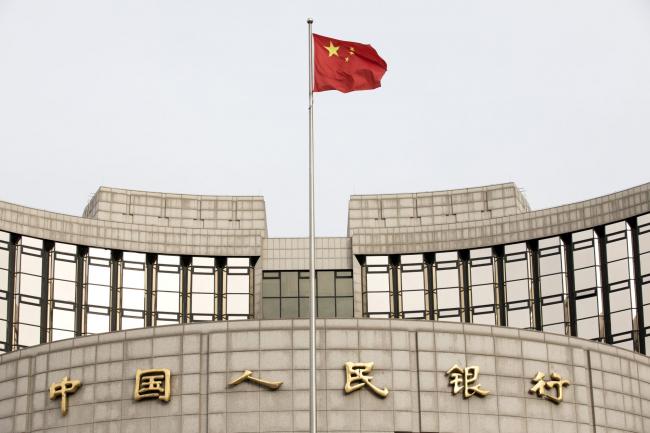

The People’s Bank of China will inject 50 billion yuan ($7.1 billion) into the banking system using 7-day reverse repurchase agreements, according to a statement Monday. It cut the interest rate to 2.2% from 2.4%.

The move comes after China’s top leaders signaled Beijing is preparing larger-scale stimulus to counter the economic fallout from the coronavirus. The PBOC re-emphasized it will keep liquidity sufficient to help the real economy while watching out for inflation risks.

With output crippled by factory shutdowns and transport curbs this quarter, China’s economy is now threatened further by a collapse in external demand due to the spread of the deadly disease around the world. That’s prompting a shift by policy makers who until now have stuck to a stimulus plan far more modest than those being rolled out by global counterparts.

The PBOC has previously said that market liquidity is sufficient. Earlier this month, Beijing added 100 billion yuan of liquidity into the interbank market with its medium-term lending facility. It also reduced the amount of cash lenders need to set aside as reserves, unleashing 550 billion yuan in long-term funds.

©2020 Bloomberg L.P.