By David Shepardson

SHANGHAI (Reuters) -U.S. Commerce Secretary Gina Raimondo talked up American firms' desire to do business in China and her hopes for further engagement with Chinese officials on market access on Wednesday, after earlier comments over China being "uninvestible."

At a press conference in Shanghai, Raimondo said she had not expected any breakthroughs on issues affecting U.S. firms such as Intel (NASDAQ:INTC), Micron (NASDAQ:MU), Boeing (NYSE:BA), Visa (NYSE:V) and Mastercard (NYSE:MA) in her first meetings with Chinese officials, but did hope to "see some results" in the next few months as a result of her four-day visit to Beijing and Shanghai.

Raimondo said there was strong appetite among U.S. businesses to make the relationship work and that, while some actions of the Chinese government have been positive, the situation on the ground needed to match the rhetoric.

"There is appetite among U.S. business to continue to do business (in China). The market is enormous," she said. "U.S. businesses want to do business here but they need to have a predictable regulatory environment."

The commerce secretary is the latest Biden administration official to visit China in a bid to strengthen communications, particularly on economics and defence, amid concern that friction between the two superpower could spiral out of control.

Raimondo insists the U.S. does not want to decouple from China. "I am leaving with some optimism," Raimondo said of agreements to continue dialogue on a lot of tough issues. "We can't drift to a place of greater of conflict. It's not good for the U.S., it's not good for China, it's not good for the world."

On Tuesday she had told reporters on a high-speed train to Shanghai from Beijing that American companies had complained to her that China has become "uninvestible," pointing to fines, raids and other actions that have made it risky to do business in the world's second-largest economy.

On Wednesday she said: "For U.S. business in many cases patience is running thin and it's time for action."

Raimondo said she had raised with Chinese officials that her emails had been hacked and said that was an "action that erodes trust." Reuters reported in July that Raimondo was among a group of U.S. officials whose emails were hacked earlier this year by a group Microsoft (NASDAQ:MSFT) says is based in China.

Her comment on the difficulties U.S. businesses face has shone a harsh light on trade and investment flows between the geopolitical rivals.

"The essence of China-U.S. economic and trade relations is mutual benefit," Wang Wenbin, a Chinese Foreign Ministry spokesperson, said on Wednesday, citing Premier Li Qiang's remarks during his meeting with Raimondo on Tuesday.

"Politicizing and securitising economic and trade issues not only seriously affects the relationship and mutual trust between the two countries, it also harms the interests of their businesses and peoples," he added.

Companies have been at the center of a power struggle between the two countries for several years. China has criticised U.S. efforts to block China's access to advanced semiconductors through export controls.

Raimondo said export control dialogue was to reduce misunderstandings.

"We were able clarify at the first meeting that we are not targeting China," she said. "We're targeting actions and behaviour that undermine U.S. national security." She reiterated on Wednesday that the United States is not willing to negotiate or change export controls.

INVESTMENT FLOWS

The two biggest economies in the world used to be each other's largest trade partners, but Washington is now trading more with neighbouring Canada and Mexico, while Beijing is trading more with Southeast Asia.

Global investors, who have been spooked by unpredictable crackdowns in China on sectors from e-commerce to education in recent years, have also been streaming out of Chinese assets lately.

Foreign net selling of 82.9 billion yuan ($11.4 billion) in Chinese stocks this month is a record outflow. Corporate investment is also going missing, with foreign direct investment (FDI) at its lowest since records began 25 years ago.

Michael Hart, president of the American Chamber of Commerce in China, said businesses had been "very clear" in making their concerns known to the Chinese government.

"Certain actions, including raids on companies and restricting data flows, are not conducive to attracting additional FDI," Hart said.

That sentiment was echoed by Jens Eskelund, president of the European Union Chamber of Commerce in China, who said "'uninvestible' is not a term we would use to describe China," instead describing it as "under-invested".

'WHOLE NEW LEVEL OF CHALLENGE'

Raimondo said U.S. firms were facing new challenges, among them "exorbitant fines without any explanation, revisions to the counterespionage law, which are unclear and sending shockwaves through the U.S. community; raids on businesses – a whole new level of challenge and we need that to be addressed."

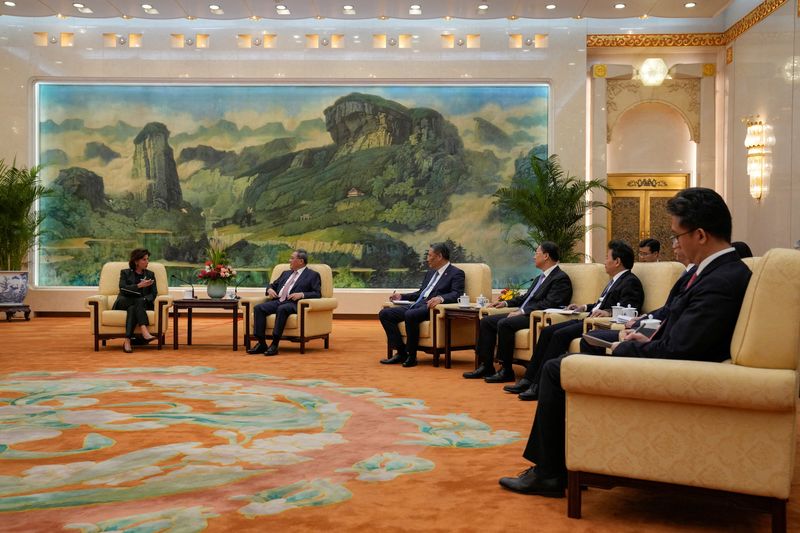

Raimondo, in opening remarks at a meeting on Wednesday morning with Shanghai Communist Party Secretary Chen Jining, struck a positive tone, saying she wanted to discuss "concrete ways that we can work together to accomplish business goals and to bring about a more predictable business environment, a predictable regulatory environment and a level playing field for American businesses."

Chen said a stable relationship between China and the United States was crucial for the world, adding that Shanghai had the highest concentration of U.S. businesses in China.

On Wednesday afternoon, the commerce secretary visited Shanghai Disneyland and a Boeing facility in the city, touting two prominent American exports.

Disney has emphasized its Chinese links since Shanghai Disneyland - a joint venture with state-owned Shendi Group - opened in 2016.

Raimondo, who has said China was blocking tens of billions of dollars in deliveries of Boeing airplanes to Chinese airlines, on Tuesday said she raised the airlines' refusal to accept delivery of Boeing 737 MAX airplanes but won no commitments.