By Clare Jim and Donny Kwok

HONG KONG (Reuters) -China Evergrande New Energy Vehicle Group said on Monday its Vice Chairman Liu Yongzhuo has been detained and is under criminal investigation, sending its stock tumbling and marking another setback after a share sale plan was scrapped.

The detainment could also hurt its parent company, China Evergrande (HK:3333) Group - the world's most indebted property developer whose offshore debt restructuring proposals comprise swapping part of its debt for equity in the EV arm. It has some $23 billion in offshore debt and more than $300 billion in total liabilities.

Evergrande NEV said Liu has been detained on suspicion of "illegal crimes" but did not elaborate further.

Hui Ka Yan, chairman and founder of parent Evergrande Group, has also been under investigation for suspected crimes, according to a filing in late September.

The automaker's shares, which were suspended from trade in the morning session pending the statement, fell as much as 23% in the afternoon but pared losses to be last down 7%.

That slide comes on top of a 19% plunge last week after its plans to sell new shares worth nearly $500 million to U.S.-listed NWTN were abandoned. It now has a market value of just HK$4.2 billion ($540 million).

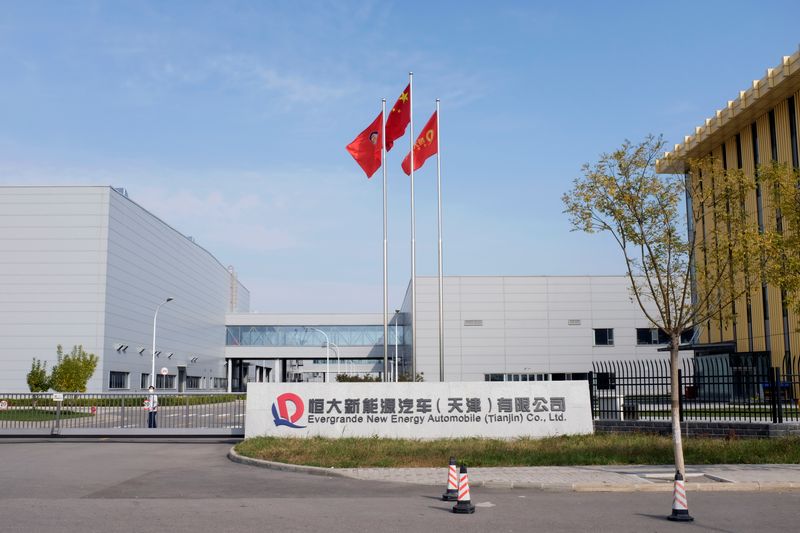

The EV maker has been financially stressed since its parent company became mired in its debt crisis around mid-2021, and it has repeatedly warned that it might have to wind up operations unless it obtains new funding.

It reported a net loss of 6.9 billion yuan ($964 million) in the first half of 2023, following a combined net loss for 2021 and 2022 of nearly $10 billion.

At one point, Evergrande NEV had lofty ambitions of making a million vehicles a year by 2025. But it sold just over 760 units of the Hengchi 5, its only EV model on the market, in the first half of last year.

($1 = 7.1562 Chinese yuan)

($1 = 7.8080 Hong Kong dollars)