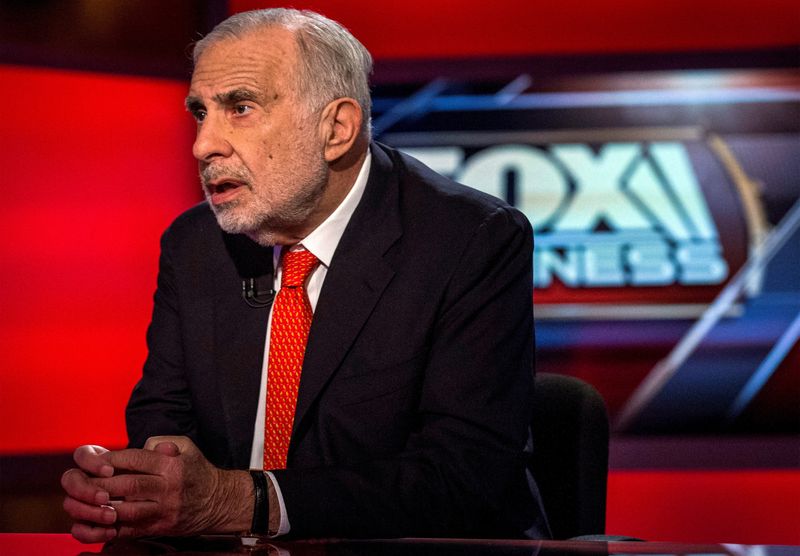

(Reuters) - Shares of billionaire Carl Icahn's investment firm plunged to their lowest in nearly two decades on Thursday, a day after old rival Bill Ackman called out the company's high valuation.

Icahn Enterprises LP's stock tumbled as much as 24.7% to $18.03, deepening losses of more than 60% that were recorded following short-seller Hindenburg Research's scathing attack on the company three weeks ago.

"(IEP's dividend) yield is generated by returning capital to outside shareholders, which is in turn funded by the company selling stock to investors," Ackman tweeted on Wednesday, echoing Hindenburg's allegation that IEP was relying on a "Ponzi-like structure" to pay dividends.

Ackman said he held no long or short positions in the stock.

In a memorable clash a decade ago, the billionaire had shorted supplement company Herbalife (NYSE:HLF), in which activist investor Icahn was a shareholder.

IEP did not respond to requests for comment on Ackman's tweet.

At least one technical indicator suggests that the selloff in IEP shares is overdone, with the stock having traded below 30 on the relative strength index (RSI) since May 22.

An RSI score of 70 and above points to an overbought stock, while a reading of 30 or below indicates that it is oversold.