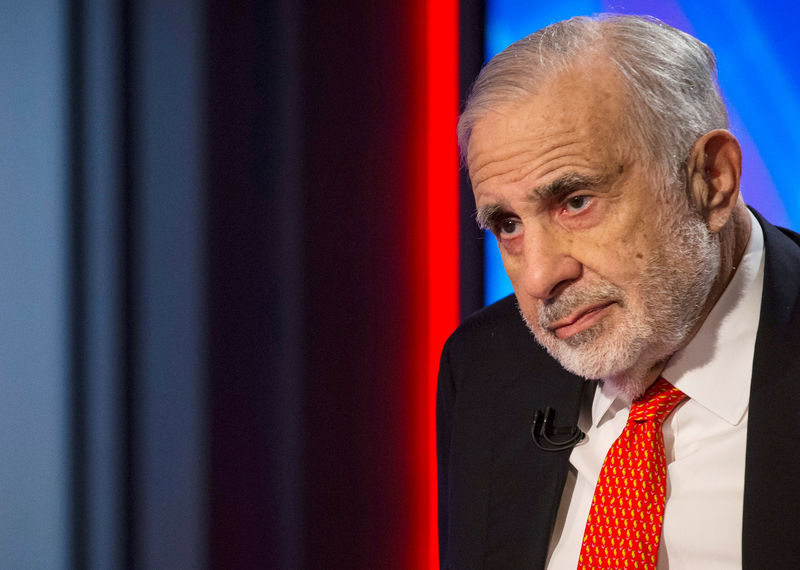

(Reuters) - SandRidge Energy Inc's top shareholder and activist investor Carl Icahn blasted the oil and gas company's move to adopt a poison pill plan amid strong opposition to its $746 million bid for Bonanza Creek Energy Inc.

In a letter to SandRidge's board, Icahn called the proposed deal "value-destroying" and said the shareholder rights plan adopted earlier this week was designed to prevent large shareholders from campaigning against the deal.

"On November 26, 2017, in direct response to this strong shareholder opposition to the proposed acquisition, you adopted a poison pill that is a complete travesty and represents a new low in corporate governance," Icahn said in the letter on Thursday.

Icahn's letter comes a week after he disclosed a 13.5 percent stake in SandRidge and joined other major shareholder Fir Tree Partners in opposing a move that they said would drain all of the company's cash.

SandRidge responded, saying in a statement that its board fully supports the acquisition and expects before year-end to file proxy materials "which will give shareholders the ability to fully review the merits of the transaction."

While Icahn said he is not currently taking any action against the company, he is considering seeking proxies from shareholders to vote against the Bonanza deal and is also prepared to initiate litigation.

SandRidge's shares were up 3.2 percent at $18.70. Bonanza Creek shares were marginally up.