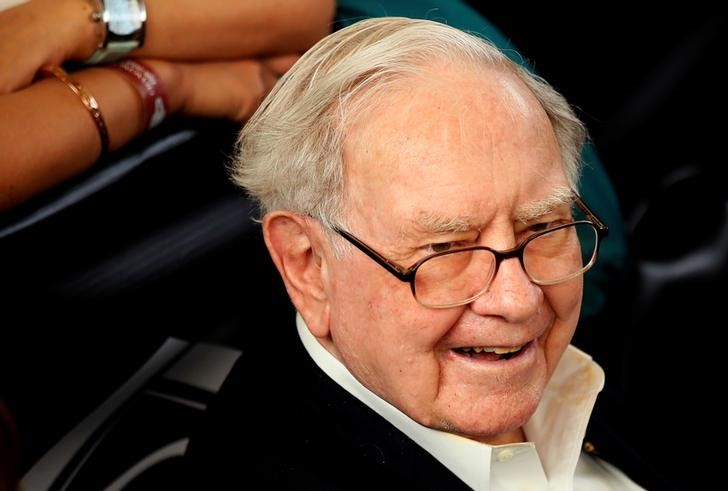

(Reuters) - Shares of Berkshire Hathaway (N:BRKa), the conglomerate run by billionaire Warren Buffett, could see double digit gains over the next year and a half even if the legendary chairman and chief executive decides to retire, a report in Barron's financial newspaper said.

The company's Class A shares could have an upside of 15 percent to 20 percent through the end of 2018 based on likely growth in its book value, given the company's diversified earnings stream, long-term focus and nearly $100 million (76.7 million pounds) in cash and securities, Barron's said in it May 22 edition.

Barclay's analyst Jay Gelb, quoted in the article, forecast Berkshire's book value rising 9 percent to 10 percent annually over the next two years.

Buffett's eventual successor is likely to begin paying a dividend and be more aggressive in buying back shares, the report predicted. Barron's sees Berkshire Hathaway Energy head Greg Abel as the most likely person to be tabbed to "step into Warren Buffett's legendary shoes."

Berkshire shares, which rose 23 percent in 2016, are flat this year after giving back gains seen earlier during the post-election rally. They closed at $244,910 on the New York Stock Exchange on Friday.