(Bloomberg) -- India’s central bank raised limits for overseas investors that could lure $16 billion of additional funds into the nation’s sovereign as well as corporate debt.

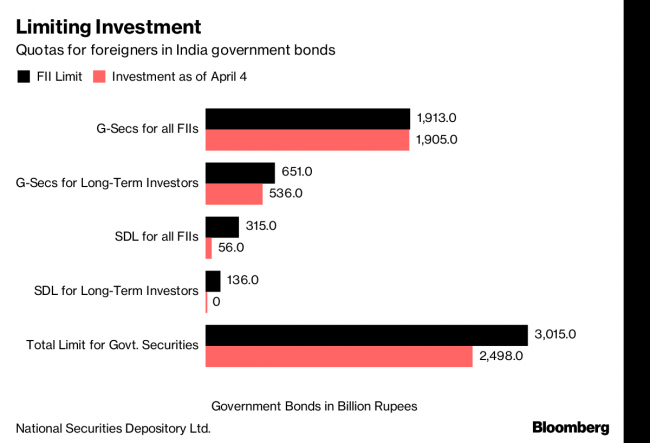

Foreign investors will be allowed to increase holdings of sovereign, state and corporate bonds by 1.04 trillion rupees ($16 billion) in the fiscal year to March 2019. Overseas investors can boost holding of central government securities by 0.5 percentage points a year, taking the limit to 5.5 percent in fiscal year to March 2019 and to 6 percent in the following 12 month period, the Reserve Bank of India said in a statement Friday. The central bank set 9 percent as the limit for foreign investors to own in debt sold by Indian companies.

In the past two weeks, the government has trimmed its fiscal first-half borrowing plans to reduce debt supply, and the central bank allowed lenders to spread out bond-trading losses to spur demand. The steps cooled bond yields, which had reached a two-year high to threaten the borrowing plans of Prime Minister Narendra Modi’s administration. While traders have cheered the initiatives, a trade war brewing between the U.S. and China may fuel volatility and reduce demand for emerging market assets.

"Real return on India’s debt is relatively higher than other emerging market nations, and hence this limit increase will be quickly lapped up by foreigners,” said Dwijendra Srivastava, chief investment officer for debt at Sundaram Asset Management Co. “Demand for both government and corporate bonds from global investors is seen as robust,” except if the trade war between the world’s two largest economies intensifies, he said.

Indian sovereign bonds posted their biggest weekly gain since November 2016 after the central bank’s move to lower its inflation forecasts spurred optimism it won’t be raising interest rates anytime soon. The yield on sovereign bonds due January 2028 dipped to 7.18 percent on Friday from 7.40 percent the prior week. The rupee gained 0.3 percent last week against the dollar.

Government bonds had fallen for seven straight months to February, the deepest selloff in two decades as excessive debt supply, quickening inflation and higher global yields soured sentiment. State banks, the biggest holders of the securities, have swung to become net sellers this year as the rout saddled them with losses.

While Modi’s government had initially wanted to borrow a near-record 6.06 trillion rupees in the fiscal year that started April, it reduced the target by 500 billion rupees last month in an effort to calm the bond market. It was forced to cancel or cut back on debt sales earlier this year.

The central bank’s Friday announcement follows a 2015 review when policy makers said the cap will be raised to 5 percent of outstanding debt by March 2018, from an estimated 3.8 percent then.

Foreign investors bought 1.4 trillion rupees of bonds in 2017, the highest since 2014. While they still purchased 95.24 billion rupees in January, they became net sellers in the last two months.

The RBI also announced that the limit for foreign portfolio investment in state development loans would remain unchanged at 2 percent of outstanding securities. It will discontinue existing sub-categories in corporate bonds and there will now be a single limit for such debt.