By Tim Hepher and Eric M. Johnson

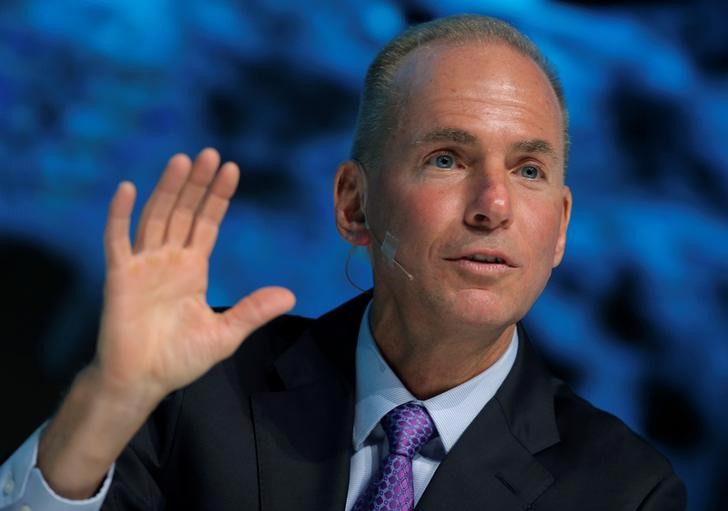

FARNBOROUGH, England (Reuters) - Boeing (N:BA) will press for deeper price cuts from suppliers with overlapping operations once it completes its planned acquisition of the regional jet business of Brazil's Embraer, Chief Executive Dennis Muilenburg told Reuters on Tuesday.

"The key thing you are going to see is that through the combination between Boeing and Embraer, we will be able to increase volume for our supply chain, which is generally going to be beneficial. And that beneficial volume should also turn into more affordability and competitiveness," he said.

Asked if he would expect further price cuts over and above those baked into Boeing's Partnering for Success cost-cutting drive, he said: "Yes. Because you'll see additional increases in volume. And a very typical discussion we'll have with our supply chain is if there's an opportunity for them to increase volume or access to additional platforms, if we can gain a cost advantage in the marketplace, that's a mutual benefit."

Boeing, meanwhile, continues to "keep a very close eye" on consolidation trends among its major suppliers and will continue to expand where it sees it necessary to support its business.

"In some cases, consolidation can be beneficial where it allows the supply chain to take costs out. If we get to a point where consolidation is reducing our sources to a level where we can't stand, we've had the opportunity to build new sources of supply. We always have that flexibility," Muilenburg said.

Muilenburg indicated Boeing would continue to push into areas traditionally dominated by its suppliers, by bringing some parts of the supply chain in-house, a process known as vertical integration.

Some aerospace suppliers have been rattled by Boeing's recent moves to integrate parts. In the most recent example, it set up a joint-venture with France's Safran (PA:SAF) to break into the highly concentrated market for auxiliary power units.

"We are very targeted in that area," Muilenburg said, when asked where he would set the limits for such expansion.

Boeing has 30-40 categories or "verticals" across its platforms and when deciding which ones to invest in, it will be driven first by what adds value and then by whether there is a good services business attached, he said.

Muilenburg was speaking shortly after Boeing unveiled a higher 20-year demand forecast for passenger jets driven by the untapped travel demands of a steadily expanding global middle class.

He did not see any reason to modify those forecasts despite global trade tensions.

"In the past where we had an aerospace sector that was largely dominated by U.S. and Europe, our backlogs were dominated there ... it's a much more globally distributed [business] today."