By Eric M. Johnson

SEATTLE (Reuters) - Boeing (NYSE:BA) Co expects to deliver roughly as many 737 narrowbody jetliners in September as the company delivered in August as it works to bounce back from a manufacturing logjam triggered by supplier delays, its CEO said on Wednesday.

Boeing's August delivery of 48 narrowbody aircraft, announced on Tuesday, was an improvement over the 29 delivered in July, which was one of its lowest monthly tallies in years.

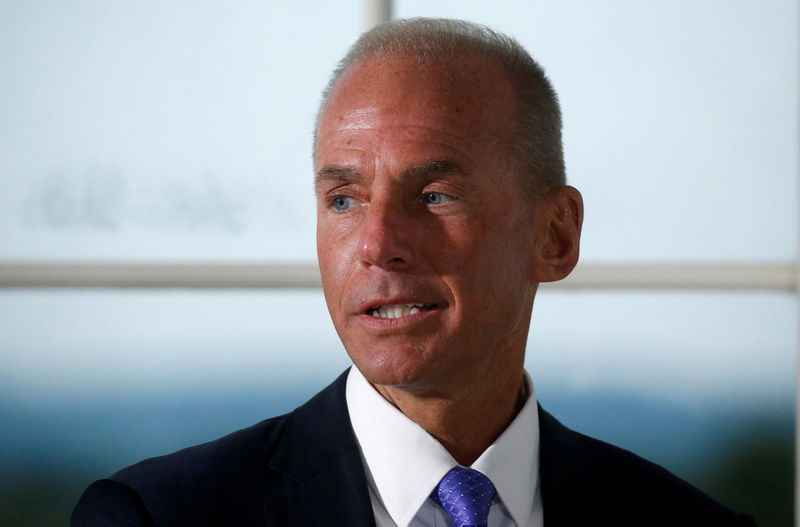

"Our recovery actions are taking hold," Boeing Chief Executive Officer Dennis Muilenburg told a conference in California. "You'll probably see September deliveries will be roughly where August was, maybe a little bit better."

"As we get into the fourth quarter, you will see deliveries getting above the 52 per month production rate," Muilenburg added.

Boeing shares were up 2.6 percent to $354.43 in mid-day trading.

Boeing's hot-selling 737 and the Airbus A320 family of single-aisle jetliners are the cash cows of the two aircraft makers, the world's largest.

The snarl at Boeing's Seattle-area narrowbody plant, fueled by shortages of engines and fuselages as Boeing sped production to record levels in June, is likely to hurt third-quarter results and threatens to hinder its efforts to boost build-rates again in 2019, some analysts said.

Boeing is committed to boosting production even further in 2019 to 57 planes per month despite parts shortages and delays, Muilenburg said, adding that "every step of the way ... we are going to be bringing our supply chain along."

Muilenburg's comments come as Boeing's 787 widebody assembly plant in North Charleston, South Carolina remained shuttered for a second day due to the threat of Hurricane Florence. A Boeing spokeswoman said operations remained suspended on Wednesday with no guidance on when production would resume.

"We've seen a few normal supply chain pressures on 787," Muilenburg said, citing seats. "We are very firm on our year-end guidance on 787."

Boeing's CEO also said the company was on track to bring the 777X widebody into service in 2020 despite engine snags, and the company was making good progress building the business case for a possible new mid-market jet, one of its most significant decisions in years.

Muilenburg said rising global trade tensions have not yet had a material impact on Boeing's business.

"While the trade rhetoric continues, the tariff rhetoric continues ... nothing here is going to create a sudden change in profile or deliveries or orders volume," Muilenburg said. "It's more of a long-term issue."