By Jarrett Renshaw and Chris Prentice

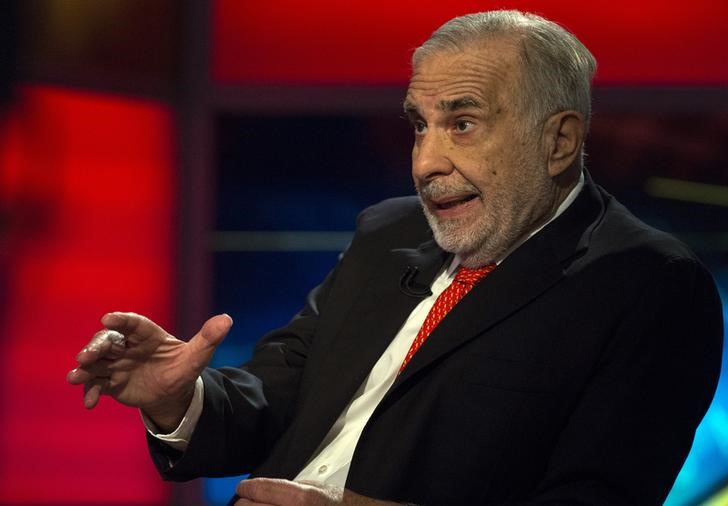

NEW YORK (Reuters) - Carl Icahn's big bet on falling prices for biofuels credits generated a rare profit in that area last quarter for the billionaire investor's refining company CVR Energy (N:CVI), according to public filings.

CVR Energy's refining unit (N:CVRR) posted a net gain of $6.4 million associated with the credits, a $50 million turnaround from the year-ago period when CVR shelled out $43.1 million, the company said in a U.S. Securities and Exchange Commission (SEC) filing Monday.

Such a gain is extremely rare. Normally, independent refiners spend tens of millions of dollars on biofuels credits. But CVR, majority owned by Icahn, delayed the purchase of about $186 million in credits into 2017 and instead sold millions of them, Reuters reported last month, positioning themselves to profit if the price fell.

This occurred as the U.S. government weighed an overhaul of its renewable fuels policy. In February, Icahn, an informal advisor to President Donald Trump, delivered a proposal to revamp the program to the White House.

The filing suggests the gambit worked, posting a gain that Barclays (LON:BARC) Capital equity analyst Paul Cheng termed "impossible."

"No one has ever done anything like this ... You're essentially betting that you really believe there's a strong probability the government will make a change for the (biofuels) program. Most people are uncomfortable making a directional bet like that," he said.

Under the Renewable Fuel Standard (RFS) program, the government awards credits to firms that blend biofuels like ethanol in their fuel pool and requires firms that don't, such as CVR, to buy credits from competitors. Icahn has been among the biggest national critics of the program, arguing it puts merchant refiners at the mercy of speculators operating in an opaque market.

He has pushed for shifting the point of obligation, or who pays for the credits. Icahn's relationship with Trump in part caused RINs prices to slump following Trump's victory, directly benefiting CVR. Democrats have accused Icahn of self-dealing, which he has denied.

Renewable fuel credits in the first quarter averaged about 53 cents, down about a third from the average price in 2016, according to prices compiled by Oil Price Information Service. The company used fair value accounting to mark down its credit liability and post a net gain, or "negative expense," of $6.4 million for the quarter.

"The net RINs expense includes the impact of recognizing the Partnership’s uncommitted biofuel blending obligation at fair value based on market prices," the company said in its filing.

CVR, which declined to comment for this story, said it expects full-year expenses of around $170 million. A Reuters review of CVR's SEC filings showed it had not previously mentioned the term "negative expense."

The gain was first disclosed on the refiner's earnings call on Thursday, but analysts expressed confusion after the company's chief financial officer Susan Ball described the "impact" as a "negative $6.4 million" and later described that value as a "negative expense."

At the end of the first quarter, CVR's bill for RINs sat at $180.3 million, the filing said. Given the fall in credit prices, the lingering size of the obligation shows the company extended its bet that prices would continue to fall.

Other refiners spent much more in the quarter: Valero Energy (N:VLO) spent $146 million, while Marathon Petroleum Corp (N:MPC) costs came to $97 million.

A Reuters analysis showed CVR built up a large short position in the months leading up to Trump taking office.

The outstanding liability has further inflated the amount of cash that CVR has, boosting its refining margins, said Barclays' Cheng.