By Kanishka Singh

WASHINGTON (Reuters) - U.S. President Joe Biden on Tuesday vetoed a resolution that would disapprove of the Consumer Financial Protection Bureau's small-business loan rule, saying the resolution would hinder the government's ability to conduct oversight of predatory lenders.

The resolution, which passed with support from just five Democrats in the U.S. Senate in October and the Republican-controlled House of Representatives earlier this month, nullified a CFPB rule that required financial institutions to collect and report credit application data for small businesses to the bureau.

The CFPB rule was already facing legal challenges. In July, a federal court had ordered the CFPB not to implement the rule until a related pending case is resolved.

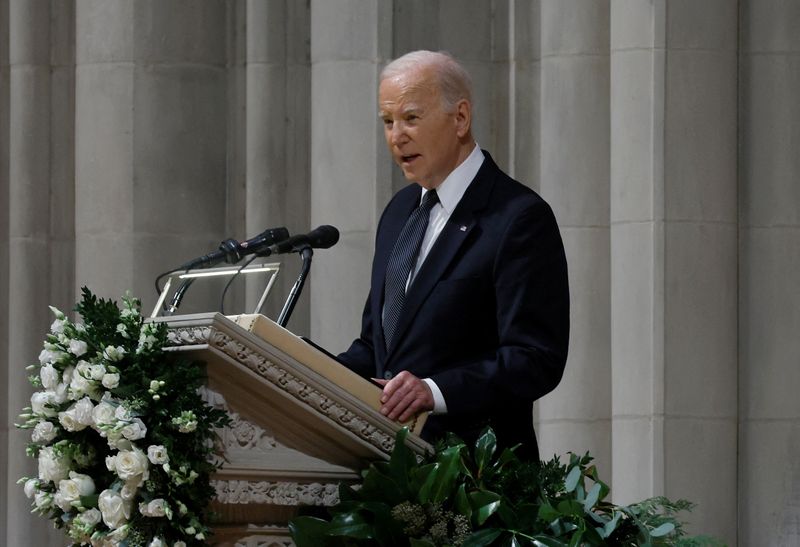

"If enacted, this resolution would harm all those that stand to benefit from expanded transparency and accountability," Biden said in a statement released by the White House.

The Democratic U.S. president accused Republicans of "hampering efforts to promote transparency and accountability in small business lending" and "siding with big banks and corporations over the needs of small business owners."

The top U.S. government agency for consumer financial protection had unveiled its long-awaited final rule for data collection on loans to small business in March and said the rule would help combat discrimination and promote investment.

The legal mandate for the rule is as old as the CFPB itself, having been created under the 2010 Dodd-Frank Wall Street reform legislation in the wake of the global financial crisis.

"This (CFPB) rule implements a long-overdue piece of the Dodd-Frank Wall Street Reform and Consumer Protection Act," Biden said in his statement on Tuesday.

Many Republicans have opposed the CFPB from the start, saying it wields too much power and burdens banks and other lenders with unnecessary red tape. Many Democrats and consumer watchdog advocates say the CFPB is key to protecting consumers from deceptive and abusive practices by lenders and debt collectors.