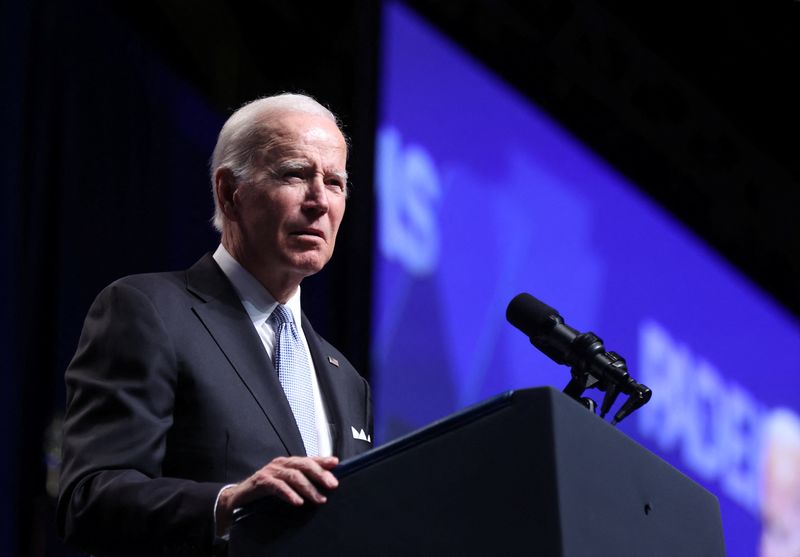

WASHINGTON (Reuters) -U.S. President Joe Biden on Monday called on oil and gas companies to use their record profits to lower costs for Americans and increase production, or pay a higher tax rate, as he battles high pump prices with elections coming in a week.

In remarks at the White House, Biden criticized major oil companies who are bringing in big profits while Americans, weary of inflation, pay a tidy sum to fill up their cars.

The oil industry “has not met its commitment to invest in America and support the American people,” he said. They’re not just making a “fair return” he said, they’re making “profits so high it is hard to believe,” Biden said.

“Their profits are a windfall of war,” he said, of the conflict that is ravaging Ukraine, and they have a responsibility to act.

“I think it’s outrageous,” he said. If they passed those profits on to consumers, gasoline prices would be down about 50 cents, he said.

“If they don’t, they’re going to pay a higher tax on their excess profits, and face other restrictions,” he said. The White House will work with Congress to look at these options and others. “It’s time for these companies to stop war profiteering.”

Biden said oil and gas companies should invest their profits in lowering costs for Americans and increasing production and that if they do not, he will urge Congress to consider requiring oil companies to pay tax penalties and face other restrictions.

The president held the event with a week to go until Americans decide whether his Democrats will remain in control of the U.S. Congress. Republicans are favored to take command of the House of Representatives, while the Senate is viewed as a toss-up.

Global energy giants including Exxon Mobil Corp (NYSE:XOM) and Chevron Corp (NYSE:CVX) posted another round of huge quarterly profits, benefiting from surging natural gas and fuel prices that have boosted inflation around the world and led to fresh calls to further tax the sector.

Whether Democrats or Republicans take control of Congress, passing a law taxing energy companies for excess profits would likely be difficult, energy experts believe.

The White House for months has been considering congressional proposals that could tax oil and gas producers' profits as consumers struggling with higher energy prices.

British lawmakers in July approved a 25% windfall tax on oil and gas producers in the British North Sea that was expected to raise 5 billion pounds ($5.95 billion) in one year to help people struggling with soaring energy bills.