By Andrea Shalal and Nandita Bose

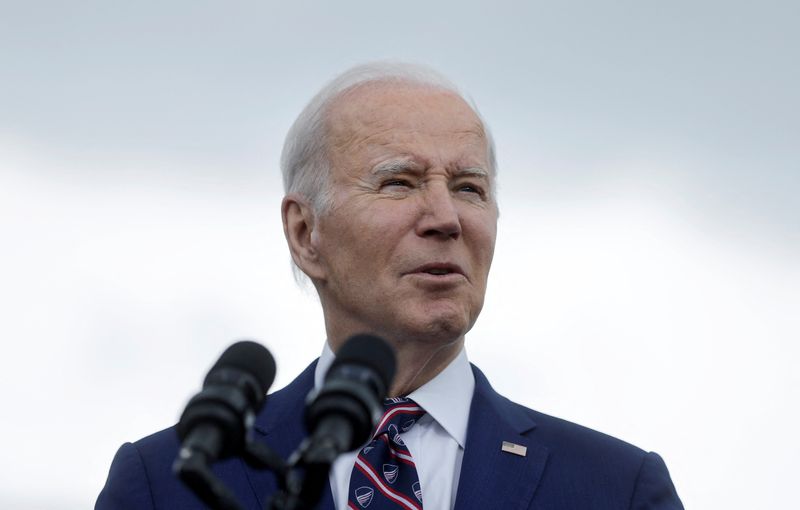

DURHAM, North Carolina (Reuters) -U.S. President Joe Biden said on Tuesday his administration had done what was possible to address the banking crisis with available authorities, but added the White House response on the matter was "not over yet."

"We've done what we need to do executively. I feel confident things are settling out. The markets seem to be responding," Biden told reporters before departing North Carolina to return to the White House.

Asked if his administration had exhausted its unilateral moves, short of congressional action, to address stress in the banking sector, Biden said: "No, it's not over yet. We're watching very closely. I think my team has handled it very well so far. And rather than get ahead of myself here, I think let's let things move the way they are."

The president said his administration was also looking at legislative changes in response to the crisis, although that could prove difficult in the split Congress.

"I'm not sure whether we get much legislative change. But we're looking at that as well," Biden said.

The failures of Silicon Valley Bank (SVB) and, days later, Signature Bank (OTC:SBNY), set off a broader loss of investor confidence in the banking sector that pummeled stocks and stoked fears of a full-blown financial crisis.

The Biden administration quickly adopted a series of emergency measures to protect depositors in the two banks, while the Federal Reserve provided additional liquidity to help banks across the sector cover depositors' needs.

Biden told reporters last week that the Federal Deposit Insurance Corporation could act to guarantee deposits above $250,000 if other U.S. banks failed, but said he expected mid-sized banks to survive current strains in the sector.

A deal to rescue Swiss bank Credit Suisse last week and a sale of SVB's assets to First Citizens Bancshares this week has helped restore some calm to markets, but investors remain wary of more troubles lurking in the financial system.

Earlier in the day, a top U.S. regulator told a Senate panel that SVB did a "terrible" job of managing risk before its collapse, fending off criticism from lawmakers who blamed bank watchdogs for missing warning signs.