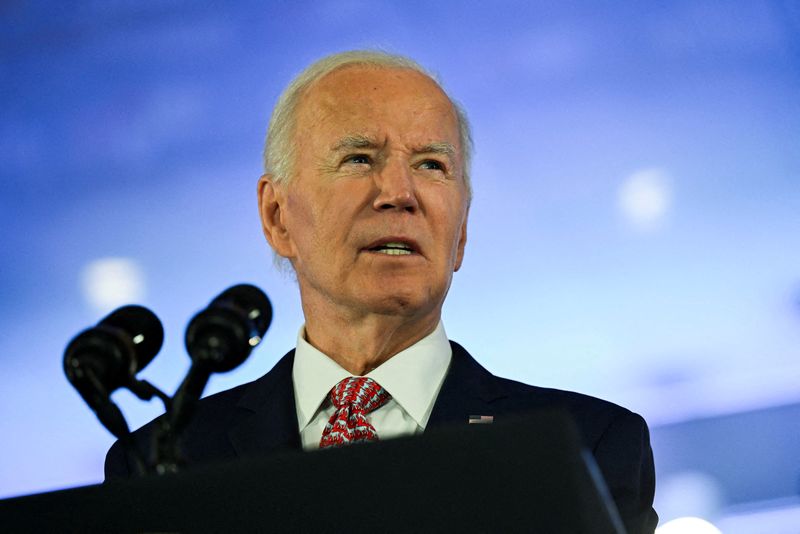

Investing.com -- Shares in U.S. Steel (NYSE:X) slipped in premarket trading on Friday after the Washington Post reported that US President Joe Biden has decided to block the sale of the company to Japan’s Nippon Steel (TYO:5401), ending more than a year of political sparring and debate over the takeover.

Citing an unnamed person familiar with the matter, news agency Reuters also reported that Biden had opted to block the proposed $14.9 billion deal.

A spokesperson for the White House and a spokesperson for Nippon Steel both declined to comment, while U.S. Steel said it hoped "Biden will do the right thing and adhere to the law by approving the transaction that so clearly enhances US national and economic security," Reuters said.

CBS News had reported earlier that Biden was set to make a decision by as soon as Friday, after the Committee on Foreign Investment in the United States referred the final decision on the deal to the White House in December.

Biden had largely opposed the takeover, as had several lawmakers, on the grounds that it could compromise US steel supplies. The United Steelworkers Union had also opposed the move, arguing it could cut US steelmaking capacity and spark layoffs.

Biden’s reported rejection of the deal comes after reports said Nippon Steel had offered the government veto power on any decisions on domestic steel production, as part of a seemingly last-ditch effort to win regulatory favor for the deal.

U.S. Steel also said on Thursday that it would set up a workforce training center in Pennsylvania on the closing of the Nippon Steel takeover.

The merger was agreed to by both companies in 2023, but has since faced repeated delays due to opposition from lawmakers and workers.

Nippon Steel was also reportedly moving to gain approval for the deal before incoming President Donald Trump takes office later in January. Trump had vowed to block the deal.

(Ambar Warrick and Reuters contributed reporting.)