By Stephen Nellis and Jane Lanhee Lee

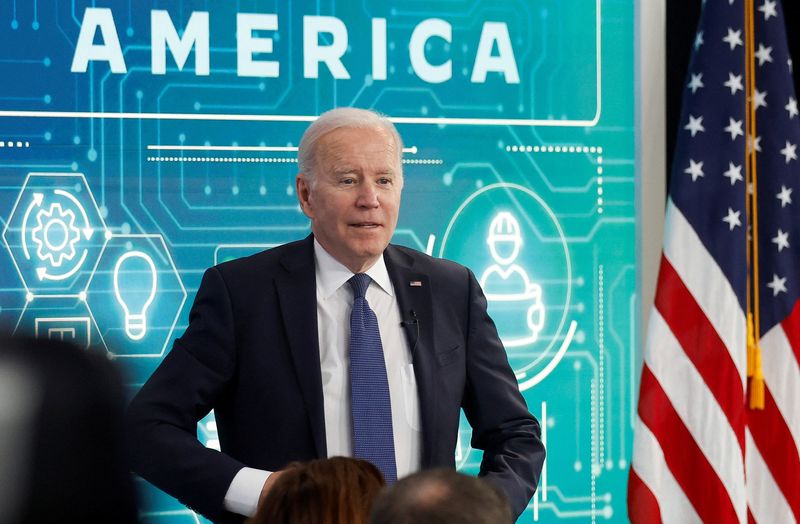

SAN FRANCISCO (Reuters) - As the Biden administration on Tuesday disclosed conditions for awarding $39 billion in subsidies to revamp U.S. semiconductor manufacturing, tech industry sources said some unexpected provisions make the funds less attractive.

Although no chip industry sources said companies would scrap expansion plans to build in the U.S., they grumbled about the U.S. Department of Commerce's broad range of rules to receive funding, from requirements to share excess profits with the government to providing affordable child care for construction workers who build the plants.

The profit sharing issue is among the most contentious. Industry sources say that the measure was a surprise and that it is unclear how it would be applied to companies, each of which will have to negotiate separate agreements with the U.S. government.

"If that's a precursor to more and deeper things (government officials) would be looking for in a negotiation stage, there's some criticism there that it could make it more challenging to do things," one semiconductor industry source told Reuters, requesting anonymity because of the sensitivity of the matter.

Industry insiders said even some of the provisions that were widely expected - such as giving priority to applicants who agree to stop share buybacks for five years after getting a grant - could be tough for some firms. Share repurchases have helped keep investors happy during tumultuous market conditions in the chip industry, which have swung from shortage to glut in two years.

“I believe this is going to cause heartburn for companies," a second chip industry executive told Reuters, requesting anonymity to discuss sensitive matters. "It’s unknown what the market is going to do. This grant would limit their flexibility.”

In announcing the rules on Tuesday, Secretary of Commerce Gina M. Raimondo said they were meant to ensure the money was spent well, and in a way that benefited workers.

“Throughout our work, we are committed to protecting taxpayer dollars, strengthening America’s workforce and giving America’s businesses a platform to do what they do best: innovate, scale and compete,” she said.

For profitable firms such as Taiwan Semiconductor Manufacturing Co, which has broken ground on a major plant in Arizona but has not said whether it would apply for U.S. funding, the buyback and profit-sharing provisions could prove a tough sell to an investor base outside of the United States.

“It’s pretty odd for a foreign company to accept this kind of meddling in its business," said a third chip industry source. TSMC did not immediately respond to a request for comment.

For chip companies that already planned on offering child care to their factory workers, the additional requirements to offer similar benefits to construction workers building new plants are "a bit of a distraction, but it’s all manageable," according to the first industry source. "I worry that some of it may slow down what people are trying to do."

A more onerous issue is that building new chip plants will probably get more expensive in the U.S., where costs are already higher than industry centers such as Taiwan and Singapore.

Although nobody expected a "free lunch," according a fifth industry source, the surprise provisions will force companies to crunch the numbers once again on U.S. plants. But the source added: "I don't think we've seen anything that's going to cause us to walk away."