By Andrew Chung

(Reuters) - A day after the U.S. Supreme Court agreed to hear arguments over the legality of President Joe Biden plan to cancel billions of dollars in student debt, his administration on Friday asked the justices to put on hold a judge's ruling in a separate case that found the program unlawful.

Rulings by lower courts in two challenges filed against the debt relief program have put Biden's policy on ice.

The administration on Friday asked the Supreme Court to pause Texas-based U.S. District Judge Mark Pittman's decision in a challenge backed by a conservative advocacy group or to hear arguments on the merits of the case at the same time that it tackles a challenge pursued by six mostly Republican-led states.

Pittman issued his ruling on Nov. 10. The St. Louis-based 8th U.S. Circuit Court of Appeals issued its injunction on Nov. 14 in a lawsuit in which Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina have argued that the administration overstepped its authority.

The justices on Thursday did not act on Biden's request to immediately lift the 8th Circuit's injunction but fast-tracked the case for oral arguments in late February or early March.

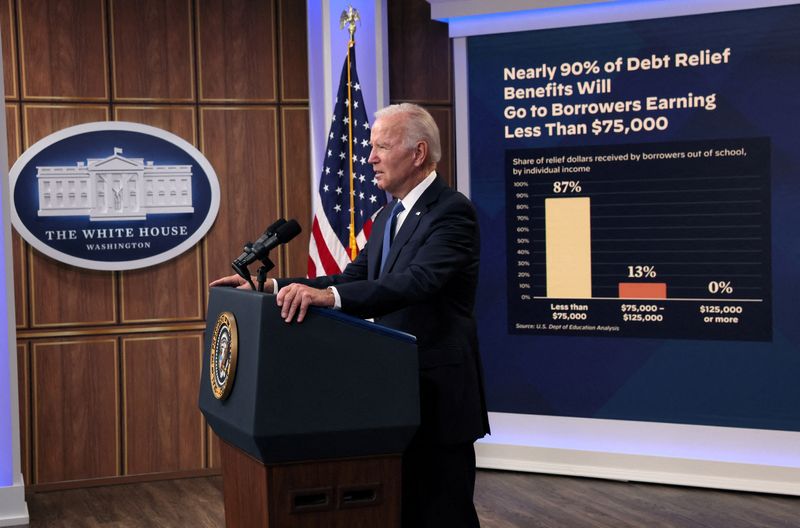

Biden announced in August that the U.S. government would forgive up to $10,000 in student loan debt for borrowers making less than $125,000 a year, or $250,000 for married couples. Students who received Pell Grants to benefit lower-income college students will have up to $20,000 of their debt canceled.

During the 2020 presidential campaign, Biden promised to help debt-saddled former college students but the program has drawn opposition from Republicans and conservative groups who say it is unfair to those who paid back their loans or never went to college and could exacerbate inflation.

The Congressional Budget Office in September calculated that the debt forgiveness program would cost taxpayers about $400 billion.

The Texas lawsuit was filed by two borrowers who were partially or fully ineligible for the loan forgiveness, backed by the Job Creators Network Foundation, a conservative advocacy group founded by Bernie Marcus, a co-founder of Home Depot Inc (NYSE:HD).

Pittman, appointed as a judge by Republican former President Donald Trump, ruled that the administration overstepped its authority to order debt cancellation under a 2003 law called the Higher Education Relief Opportunities for Students Act, which can "waive or modify" student financial assistance during war or national emergency.

The judge said it was irrelevant if Biden's plan was good public policy because the program was "one of the largest exercises of legislative power without congressional authority in the history of the United States."

Biden's administration justified its plan based on the economic harms inflicted by the COVID-19 pandemic and concerns about rising debt delinquency and lower earnings, particularly among lower-income Americans. Biden and his predecessor Trump had invoked the law to pause student loan repayments.

Biden on Nov. 22 extended the repayment pause to no later than next June 30 to give the Supreme Court time to decide the case.

The administration has said that more than 26 million borrowers have applied for loan relief and 16 million applications have been approved for discharge if allowed by the courts. It has said more than 40 million Americans are eligible for relief.