By Shariq Khan and Siddharth Cavale

(Reuters) - British American Tobacco (NYSE:BTI) said on Thursday it will buy a nearly 20% stake in Canada-based cannabis producer Organigram for about 126 million pounds ($175.8 million) as it seeks to expand beyond its main tobacco business.

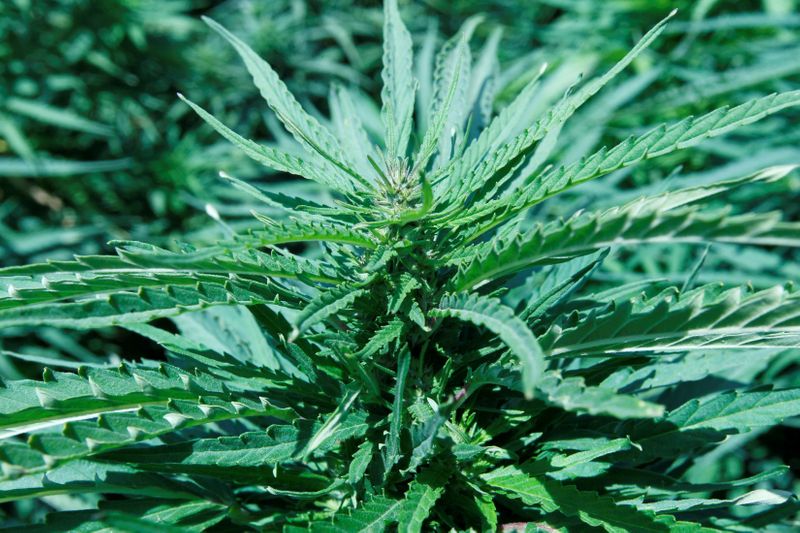

Organigram grows cannabis and makes cannabis-derived products in Canada, where marijuana was legalised in 2018.

Big tobacco and liquor companies in North America have already made large investments in the nascent industry, with cannabis seen as a less harmful alternative to cigarettes.

With top Democratic lawmakers in the United States also promising to decriminalise marijuana use, analysts and experts predict record investment in the industry this year.

The deal will give BAT (LON:BATS) access to R&D technologies, product innovation and cannabis expertise, it said in a statement, with an initial focus on natural remedy cannabidiol (CBD).

"This move takes us into a new space and we are not ruling out any product innovation," David O'Reilly (NASDAQ:ORLY), director of Scientific Research at BAT, told Reuters.

Organigram Chief Executive Greg Engel said the companies will jointly develop new products for cannabis delivery, both oral and vapour based, and will be able to commercialise any products developed under their own brands.

Both BAT and Organigram will contribute scientists, researchers, and product developers, BAT said. It will become Organigram's largest shareholder and can appoint two directors to its board.

NATURAL FIT

"We view this move as a strong positive. Cannabis overall provides a natural fit for tobacco and a big incremental growth opportunity," Jefferies (NYSE:JEF) analyst Owen Bennett wrote in an note.

BAT has expertise in operating in a regulated environment and experience of growing a crop similar to hemp CBD, Bennett said, adding that the timing of the deal before Organigram's possible entry into the United States is also a big positive.

Bennett estimates U.S. CBD market sales of over $16 billion by 2025.

Organigram's U.S.-listed shares surged around 30% to $3.75 in morning trading on the Nasdaq. BAT's London-listed shares were up slightly.

BAT's investment comes two days after the Lucky Strike maker laid out environmental, social and governance (ESG) targets, including switching more people to less harmful products.

The group aims to achieve at least 5 billion pounds in revenue from sales of e-cigarettes, tobacco heating and oral nicotine products in 2025.

Elsewhere in the industry, Marlboro maker Altria (NYSE:MO) has invested in pot producer Cronos Group (NASDAQ:CRON) Inc, while Corona beer-maker Constellation Brands Inc (NYSE:STZ) has a stake in Canopy Growth (NASDAQ:CGC), the largest cannabis company globally by market value.

($1 = 0.7167 pounds)