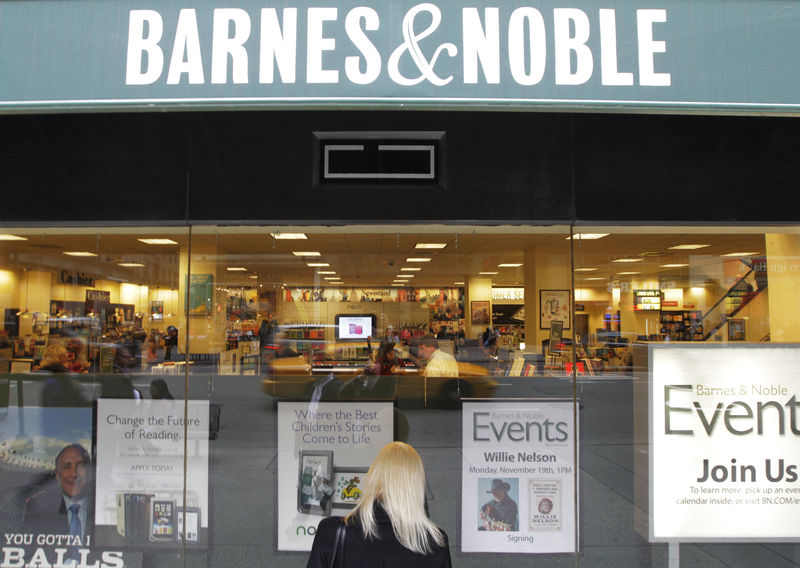

(Reuters) - Barnes & Noble (NYSE:BKS) Inc said on Wednesday it would explore strategic options after several parties, including founder-chairman Leonard Riggio, showed interest to buy the bookseller, sending its shares up as much as 24 percent in extended trading.

The No.1 U.S. book store chain also adopted a plan to thwart any hostile bid after it found a rapid accumulation of stocks by parties that the company said it could not identify.

The plan would prevent any party from accumulating 20 percent or more of its common shares by automatically offering preferred shares at a 50 percent discount to other shareholders.

Riggio, who holds the largest stake of 19.24 percent according to Refinitiv data, has committed to vote in favor of any transaction recommended by the special committee formed to review strategic options, the company said.

The New-York based company has been struggling with declining sales for years as consumers increasingly move online. Even the company's Nook e-book reader has been largely overshadowed by Amazon's Kindle and other tablets.

Nearly a month ago, investor Richard Schottenfeld disclosed a higher stake of 6.9 percent in the bookseller and said he had discussed with Riggio about a possible sale.

Schottenfeld sees better business from the bookseller's 629 stores by moving away from music and DVD sales to high-margin toys and games ahead of the holiday season and in the wake of Toys 'R' Us bankruptcy, a filing in August showed.

Schottenfeld did not immediately respond to a request for comment.

Guggenheim Securities LLC acted as financial adviser and Paul, Weiss, Rifkind, Wharton & Garrison LLP was its legal adviser.

The company's shares were up 22 percent at $6.65 in after-market trading.