By Renju Jose

SYDNEY (Reuters) - Australia's wine export growth slowed last year and could take another hit in 2020 from the coronavirus outbreak if China, its biggest market, orders fewer crates, a report by an industry body said on Wednesday.

The virus, which originated in the Chinese city of Wuhan, has severely impacted food and beverage businesses in mainland China with many global companies including McDonald's (N:MCD) and Starbucks Corp (O:SBUX) temporarily shutting stores in the country as a precaution.

"Looking ahead into 2020, we anticipate that coronavirus will have an impact on sales, particularly to China, but at this stage it is difficult to predict the degree of that impact," said industry body Wine Australia in its 2019 export report.

Australia's total global wine exports rose just 3% to A$2.91 billion ($1.96 billion) in 2019, compared with 10% growth recorded in 2018, the report said.

Wine exports to China, which is Australia's top market by value, rose 12% to A$1.3 billion last year although the pace of growth slowed from 18% recorded in 2018.

The total value of wine exports was the second highest for a calendar year, however, the volume fell for the first time in seven years, the report showed.

"The volume of exports was down, with the decline heavily weighted toward lower price segments," Wine Australia Chief Executive Officer Andreas Clark said.

"The lower vintages in 2018 and 2019, together with lower inventory levels, meant that there was less wine available for export in 2019."

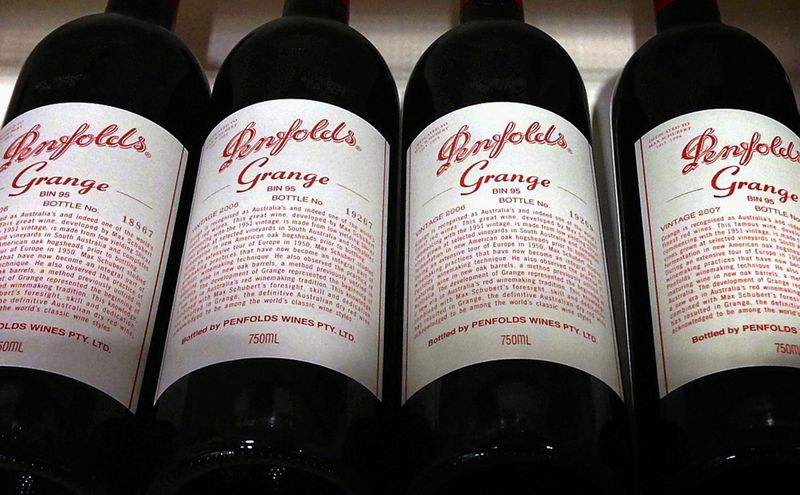

On Jan. 29, Australia's biggest winemaker Treasury Wine Estates Ltd (AX:TWE), which generates a significant portion of its sales from exports to China, said it was too early to say what the effects of coronavirus would be. However, it cut its 2020 earnings outlook citing weakness in its U.S. operations.