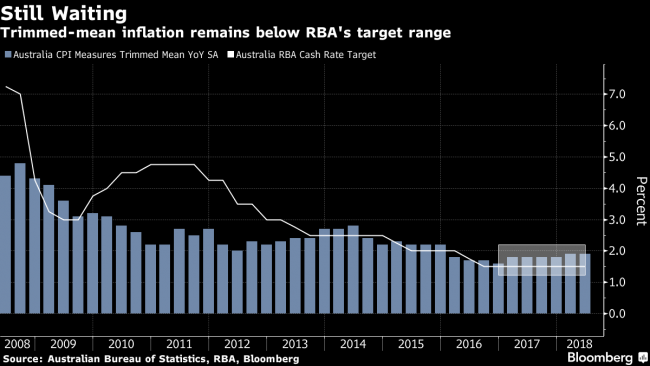

(Bloomberg) -- Australia’s inflation remained subdued in the three months through June, suggesting the central bank’s interest-rate pause will enter a third year.

Key Points:

- Quarterly trimmed-mean inflation, the key core measure, rose 0.5% vs estimated 0.5%; annual trimmed mean advanced 1.9%, also matching estimate

- Quarterly consumer price index, or headline inflation, climbed 0.4% vs estimate of 0.5%; annual CPI climbed 2.1% vs forecast 2.2%

- Quarterly weighted-median gauge, also a core measure, rose 0.5% vs estimated 0.5%, while annual gauge gained 1.9%, matching forecast

- Australian dollar fell, buying 74.14 U.S. cents at 11:48 a.m. from 74.37 cents prior to report

Big Picture

Australia is in it’s third year of subdued inflation with headline prices only boosted by a spike in oil: the crude price soared more than 60 percent in the 12 months through June. Governor Philip Lowe expects consumer prices will only gradually return to the midpoint of the Reserve Bank of Australia’s 2-3 percent target as the economy grapples with the wage weakness afflicting much of the developed world.

Policy makers are banking on a record-low cash rate of 1.5 percent to help boost hiring and tighten the labor market, while traders see little chance of a hike in the next year.

Other Details:

- Biggest quarterly price rises: automotive fuel +6.9%, medical and hospital services +3.1% and tobacco +2.8%

- Most significant price declines: domestic holiday travel and accommodation -2.7%, motor vehicles -2% and vegetables -2.9%