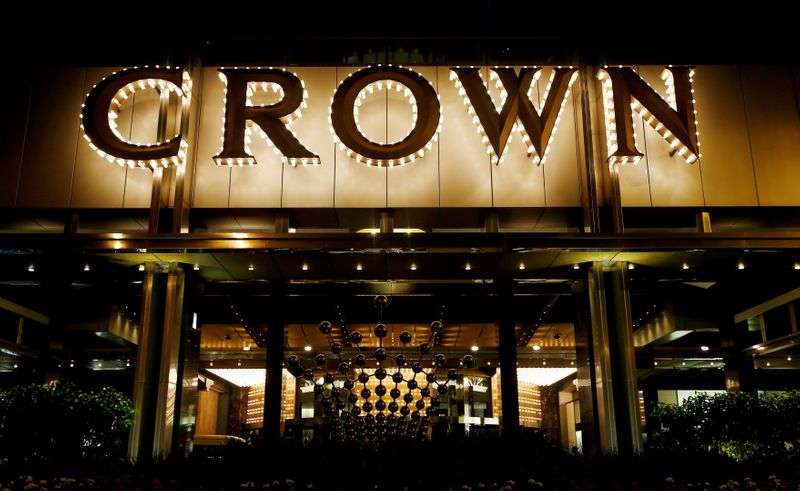

(Reuters) -Australian casino firm Crown Resorts Ltd said on Thursday investment giant Blackstone Group (NYSE:BX) Inc's $6.2 billion buyout offer did not represent "compelling value" for its shareholders.

Crown, however, added it offered Blackstone access to non-public information to allow it to undertake initial due diligence inquiries for a revised proposal.

The A$12.50-a-share proposal in November was the third from Blackstone to win control of Crown, which has faced devastating misconduct inquiries in every state it operates in and has been hurt by protracted lockdowns.

Crown added it discussed the proposal with Blackstone and its advisers and has also considered feedback from shareholders and regulators.

Blackstone did not immediately respond to a Reuters request for comment.

Crown shares have jumped over 10% since Blackstone's sweetened offer on Nov. 19, but is still shy of the A$12.50 per share offer price. Shares fell 0.5% in early trading by 2305 GMT.