By Byron Kaye

SYDNEY (Reuters) - Casino company Crown Resorts Ltd disputed some findings of an inquiry that accused it of enabling money laundering, said the head of a probe into Crown in a second Australian state, an apparent split from the company's public apology for wrongdoing.

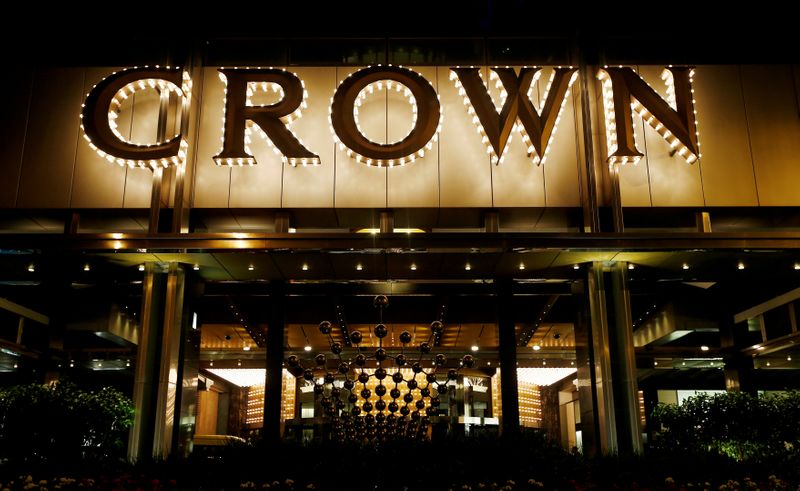

Last month, a probity inquiry in the state of New South Wales declared Crown unfit to run a A$2.2 billion ($1.7 billion) Sydney casino after finding the company dealt with tour operators linked to organised crime, allowed money laundering and disregarded the safety of a dozen and a half staff jailed in China in 2016 for breaking that country's anti-gambling laws.

That sparked Royal Commission inquiries in two other states, Victoria and Western Australia, where Crown also has operational casinos, and where the wrongdoing was found to have occurred. If those inquiries suspend Crown's gambling licence, as the Sydney regulator did, the company's main revenue would stop.

In opening remarks at the Victoria inquiry on Wednesday, the retired federal court judge presiding over hearings, Ray Finkelstein, said he had written to Crown to ask if it accepted the Sydney findings in the hope of avoiding repetition.

The company's letter of reply had not been made public, but "for now it's sufficient for me to point out Crown's response is a little equivocal", Finkelstein said on the first day of hearing.

"The Crown companies do not accept, in terms, the findings made," Finkelstein added. He noted the "disagreement ... may not be material" since the company's "objection ... goes to the deliberateness or wilfulness of the concerned conduct".

Crown did accept, in its unpublished response, the overall finding that it was unsuitable for a licence in Sydney, but maintained it was fit for its licence in Victoria because of measures it had already taken to improve governance, Finkelstein said.

A Crown spokeswoman declined to comment. On Feb. 11, Crown Chair Helen Coonan said in a statement in relation to the Sydney inquiry that "I accept criticism is warranted and reiterate our unreserved apologies for these shortcomings".

The New South Wales Independent Liquor & Gaming Authority, which commissioned the Sydney inquiry and has suspended Crown's licence, was not immediately available for comment.

Hearings for the Victorian Royal Commission resume at a date to be fixed. The Western Australian Royal Commission is yet to begin.

This week, Crown said it received a $6.2 billion buyout proposal from private equity giant Blackstone Group (NYSE:BX) Inc. Crown, which lost about half its board in the past month following the Sydney inquiry, is yet to say if it supports a takeover.

($1 = 1.3142 Australian dollars)