By Ju-min Park

SEOUL (Reuters) - Asian memory chipmakers' production plans and outlook will be closely watched as they start reporting earnings this week, following sharp falls in their stock prices due to concerns that a 2-year industry super-cycle may be skidding to a halt.

The $121 billion global memory chip industry has enjoyed an unprecedented boom since late 2016, with profits surging to record highs and margins rising above 70 percent thanks to disciplined production after years of consolidation.

But the industry's shift to a newer technology of 3D NAND flash stacks - which are cheaper to assemble than outgoing two-dimensional chips - has seen output grow faster than demand this year and forced smaller players to aggressively cut prices to keep market share.

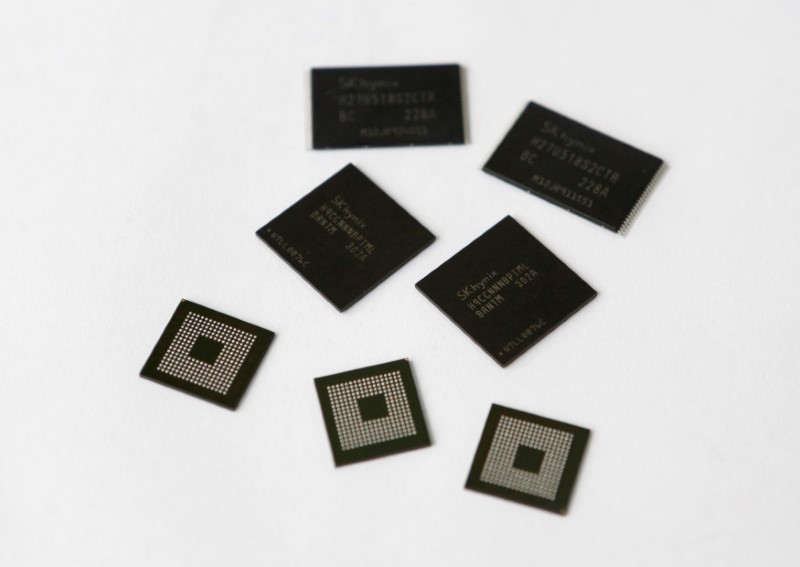

Average NAND flash memory chip prices have nearly halved from a peak in 2017, and concerns of further declines sent shares of the major producers such as South Korea's SK Hynix (KS:000660) down 7 percent on Monday.

NAND flash memory chips, used for longer-term data storage, are found in mobile devices as well as memory cards, USB flash drives and solid-state drives.

"The margins are getting worse mainly because the average selling price decrease turns out to be much faster than cost reductions," said Alan Chen, director at market research firm DRAMeXchange.

He forecast the price decline would continue for the rest of this year.

Nomura estimates supply of NAND flash chips will grow about 40 percent to 50 percent this year, just as demand eases off due to slowing global smartphone sales, causing prices to decline by nearly 20 percent.

DRAM BUSTERS

Prices of DRAM memory chips - which help servers, gaming PCs and cryptocurrency mining devices process large amounts of streaming data - are up more than 20 percent this year.

But they are losing momentum amid a Chinese price-fixing probe against industry heavyweights such as Samsung Electronics (KS:005930) Co Ltd, and Beijing's drive to build home-grown chip champions to cut its reliance on foreign supplies.

Beijing has made the semiconductor sector a priority under its "Made in China 2025" strategy, and three firms - Yangtze Memory Technologies Co Ltd, Innotron Memory and Fujian Jinhua Integrated Circuit - are getting ready to mass-produce memory chips, according to analysts.

"Until the first half of next year, Chinese firms' production scale will be small but as their yield rate gets better and leads to increased output, that will influence the semiconductor market from the second half of next year," said Song Myung-sup, an analyst at HI Investment & Securities.

Andrew Norwood, lead analyst at Gartner, said China's entry into the market could be one of the factors behind a move by Samsung to aggressively expand capacity. He said 2020 and 2021 would see "significant revenue reductions".

Others are more optimistic, pointing to demand from data centers and new technologies such as 5G mobile network and autonomous driving.

"Although profit growth momentum is likely to disappear, we believe an operating profit level of $90 billion can be sustained in 2019, instead of crumbling down badly," BNP Paribas (PA:BNPP) analyst Peter Yu said in a recent report.

"The fat and steady profit is the new norm for the memory industry."

Samsung, the world's top chipmaker, is expected to post a record profit of 12.5 trillion won ($11 billion) from chip sales in the quarter ended in June, up 50 percent from a year ago. Its hometown rival SK Hynix is also likely to report a 74 percent jump to a record 5.4 trillion won.

Hynix reports earnings on July 26, Samsung on July 31, and Japan's Toshiba Corp (T:6502) on Aug 8.

($1 = 1,133.9000 won)