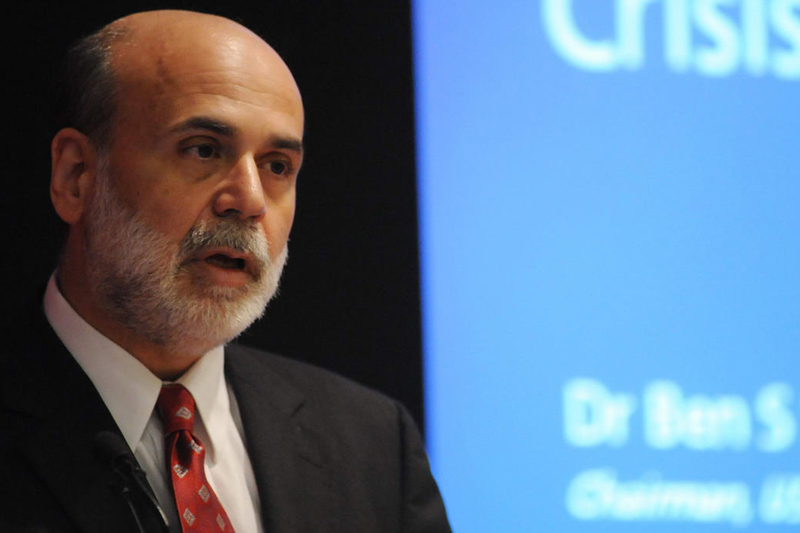

Investing.com - Asian stock markets were mostly higher during late Asian trade on Thursday, as sentiment was boosted after comments by Federal Reserve Chairman Ben Bernanke helped ease concerns over the possibility the central bank will begin to taper its bond-buying program before the end of the year.

Markets in Japan underperformed the region after the Bank of Japan made no changes to its monetary easing policy at the conclusion of its two-day meeting.

During late Asian trade, Hong Kong's Hang Seng Index rallied 2.4%, Australia’s ASX/200 Index ended 1.3% higher, while Japan’s Nikkei 225 Index added 0.4%.

Bernanke said the Fed will continue to maintain accommodative monetary policy for the foreseeable future, citing low levels of inflation and the high unemployment rate.

The comments came after the minutes of the central bank’s June policy meeting showed that Fed policymakers remain divided over when to begin tapering its USD85 billion-a-month asset purchase program.

In Tokyo, the Nikkei fluctuated near a six-week high after the Bank of Japan made no changes to its monetary easing policy, while upgrading its view of the domestic economy.

Japan’s economy was “starting to recover moderately” and exports “have been picking up,” the BoJ said in its statement.

Most exporters came under pressure as the yen strengthened by 1% against the U.S. dollar, dampening the outlook for export earnings.

USD/JPY fell to hit a session low of 98.25, moving off the previous session’s high of 101.18. A stronger yen reduces the value of overseas income at Japanese companies when repatriated, dampening the outlook for export earnings.

Meanwhile, in Australia, the benchmark ASX/200 Index ended at the highest level in six weeks following the release of stronger-than-expected employment data.

A government report released earlier showed that the economy added 10,300 jobs in June, defying expectations for a decline of 2,500. The nation’s unemployment rate rose unexpectedly to 5.7% last month from 5.6% in May.

The big four banks were mostly higher, with National Australia Bank rising 1.8%, while ANZ Banking Group and Westpac Banking Group advanced 1.2% and 1.6%. Commonwealth Bank of Australia tacked on 1.5%.

Miners advanced on the back of rising metal prices. Rio Tinto and BHP Billiton jumped 3.7% and 3.2% respectively, while Fortescue Metals Group saw shares gain 2.7%.

Gold miners Newcrest Mining and Medusa Mining surged 11.5% and 21.6% respectively.

Elsewhere, in Hong Kong, the Hang Seng rallied amid growing expectations the People’s Bank of China will introduce fresh easing measures to boost growth following the release of dismal trade data on Wednesday.

The China banking sector were among the biggest gainers on the index, with China Construction Bank shares rising 2.8%, Industrial and Commercial Bank of China climbing 2.9% and China Minsheng Bank soaring 7.5%.

Looking ahead, European stock market futures pointed to a higher open, after Fed Chair Bernanke indicated that the central bank will maintain its easy monetary policy for the foreseeable future.

The EURO STOXX 50 futures pointed to a gain of 1.4% at the open, France’s CAC 40 futures rose 1.3%, London’s FTSE 100 futures advanced 1%, while Germany's DAX futures pointed to a gain 1.2% at the open.

The U.S. was to release the weekly report on initial jobless claims later in the trading day.

Markets in Japan underperformed the region after the Bank of Japan made no changes to its monetary easing policy at the conclusion of its two-day meeting.

During late Asian trade, Hong Kong's Hang Seng Index rallied 2.4%, Australia’s ASX/200 Index ended 1.3% higher, while Japan’s Nikkei 225 Index added 0.4%.

Bernanke said the Fed will continue to maintain accommodative monetary policy for the foreseeable future, citing low levels of inflation and the high unemployment rate.

The comments came after the minutes of the central bank’s June policy meeting showed that Fed policymakers remain divided over when to begin tapering its USD85 billion-a-month asset purchase program.

In Tokyo, the Nikkei fluctuated near a six-week high after the Bank of Japan made no changes to its monetary easing policy, while upgrading its view of the domestic economy.

Japan’s economy was “starting to recover moderately” and exports “have been picking up,” the BoJ said in its statement.

Most exporters came under pressure as the yen strengthened by 1% against the U.S. dollar, dampening the outlook for export earnings.

USD/JPY fell to hit a session low of 98.25, moving off the previous session’s high of 101.18. A stronger yen reduces the value of overseas income at Japanese companies when repatriated, dampening the outlook for export earnings.

Meanwhile, in Australia, the benchmark ASX/200 Index ended at the highest level in six weeks following the release of stronger-than-expected employment data.

A government report released earlier showed that the economy added 10,300 jobs in June, defying expectations for a decline of 2,500. The nation’s unemployment rate rose unexpectedly to 5.7% last month from 5.6% in May.

The big four banks were mostly higher, with National Australia Bank rising 1.8%, while ANZ Banking Group and Westpac Banking Group advanced 1.2% and 1.6%. Commonwealth Bank of Australia tacked on 1.5%.

Miners advanced on the back of rising metal prices. Rio Tinto and BHP Billiton jumped 3.7% and 3.2% respectively, while Fortescue Metals Group saw shares gain 2.7%.

Gold miners Newcrest Mining and Medusa Mining surged 11.5% and 21.6% respectively.

Elsewhere, in Hong Kong, the Hang Seng rallied amid growing expectations the People’s Bank of China will introduce fresh easing measures to boost growth following the release of dismal trade data on Wednesday.

The China banking sector were among the biggest gainers on the index, with China Construction Bank shares rising 2.8%, Industrial and Commercial Bank of China climbing 2.9% and China Minsheng Bank soaring 7.5%.

Looking ahead, European stock market futures pointed to a higher open, after Fed Chair Bernanke indicated that the central bank will maintain its easy monetary policy for the foreseeable future.

The EURO STOXX 50 futures pointed to a gain of 1.4% at the open, France’s CAC 40 futures rose 1.3%, London’s FTSE 100 futures advanced 1%, while Germany's DAX futures pointed to a gain 1.2% at the open.

The U.S. was to release the weekly report on initial jobless claims later in the trading day.