CHICAGO (Reuters) - Illinois' pile of unpaid bills topped $16 billion for the first time as the state deals with the fallout of an unprecedented two straight fiscal years without complete budgets, the state comptroller's office reported on Tuesday.

The bill backlog is growing despite the enactment of a fiscal 2018 spending plan and income tax increase in July that ended a budget impasse between Illinois' Republican governor and Democrats who control the legislature.

"What is going to take this backlog down is the borrowing," said Abdon Pallasch, spokesman for Democratic state Comptroller Susana Mendoza.

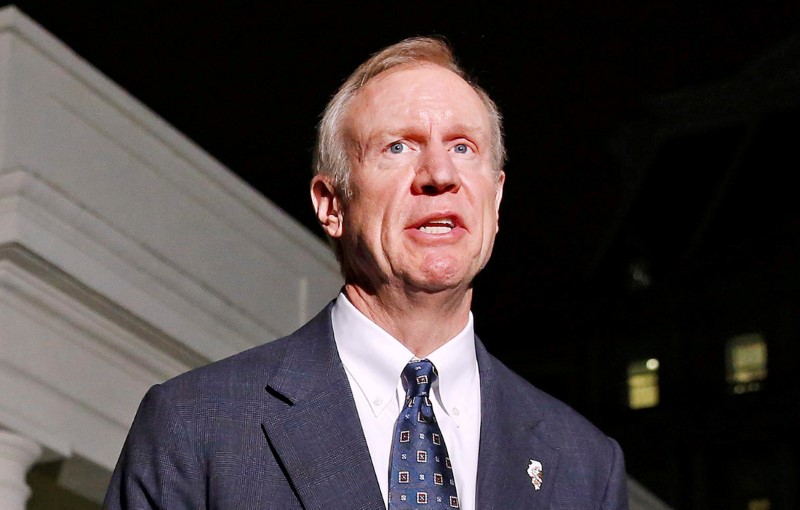

A provision in the budget enacted by lawmakers over the vetoes of Governor Bruce Rauner authorized the sale of up to $6 billion of general obligation bonds to pay bills from vendors and service providers that are accruing late payment penalties of as much as 12 percent.

Rauner signaled earlier this month that his administration will move forward with the bond sale, saying "it’s better to have Wall Street carry our debt than Main Street Illinois.”

But on Monday, the governor told reporters that the bonds do not solve any problem because lawmakers failed to set aside money to make principal and interest payments over the 12 years the debt would be outstanding.

"We need to come up with roughly half a billion (dollars) of cuts just to be able to service a bond offering," he said, adding that he planned to meet with legislative leaders for discussion.

Pallasch said school aid and pension payments this week will lower the bill backlog into the $15 billion range as the Dec. 31 deadline for issuing the bonds looms.

"The ball's in their court now and we are working with them to make this happen," he said.

Illinois, which has the lowest credit ratings among the 50 states, evaded downgrades to junk with the budget enactment. Yields on its debt in the U.S. municipal bond market also fell due to the action. The state's so-called credit spread over Municipal Market Data's benchmark triple-A yield scale for 10-year bonds has dropped to 175 basis points from a 335 basis-point high in June.