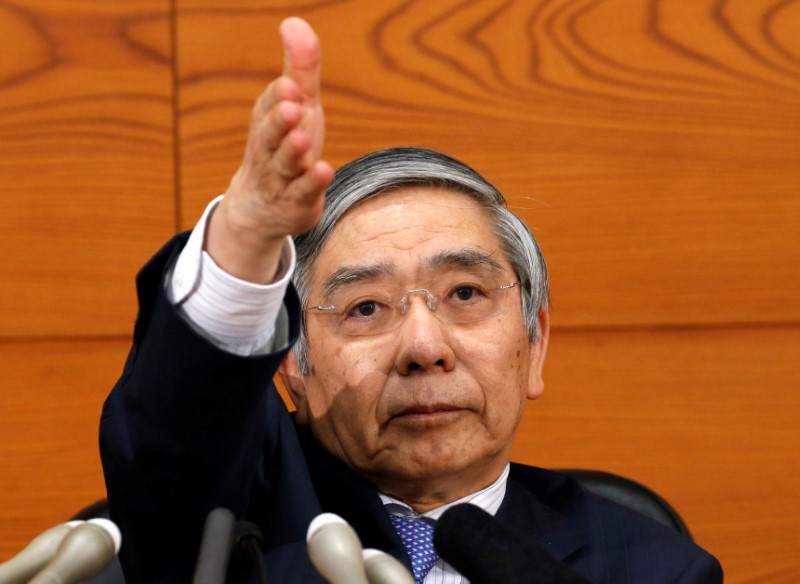

OXFORD, England (Reuters) - The Bank of Japan has far to go to reach its 2 percent inflation target, but its ultra-loose monetary policy has helped stabilize public inflation expectations, BOJ Governor Haruhiko Kuroda said on Thursday.

Japanese core consumer prices rose just 0.3 percent in Aprilfrom a year earlier, as companies remain wary of raising prices for fear of scaring away price-sensitive households.

Wage growth also remains tame, dashing central bankers' hopes that a tightening job market will lead to higher wages and give households more income to spend.

"There is still a long way to go until the price stability target of 2 percent is achieved," Kuroda said in a speech in Oxford, England.

Part of the problem is the size of Japan's elderly population. Kuroda noted that about one-third of the population are pensioners, who are less keen to see prices rising and eating into the value of their pension payments.

"This is certainly a challenge," he said.

But the main downward pressure on Japanese inflation had come from falling global oil prices, he said, adding that the global economy had remained weak in the wake of the financial crisis of 2008.

"The performance of the global economy has been by no means satisfactory," he said.

Kuroda defended the central bank's so-called "quantitative and qualitative easing" program of heavy asset buying, saying it had helped stabilize inflation expectations.

"QQE has produced its intended effects," he said.

After three years of the program failed to lift inflation significantly, the BOJ reframed its policy goal last year to one capping long-term interest rates from one targeting the pace of money printing.

Under the new framework, the BOJ guides short-term rates at minus 0.1 percent and 10-year bond yields around zero percent.

It also maintains its pledge to increase its bond holdings at an annual pace of 80 trillion yen. Some analysts believe the BOJ will soon modify or abandon that pledge as the pace of bond buying has recently slowed to around 60 trillion yen.