Investing.com – The U.S. dollar edged up against the yen on Wednesday, erasing some of its recent losses ahead of a key interest rate decision by the Federal Reserve.

USD/JPY hit 93.28 during European morning trade, gaining 0.03%. The pair was likely to find resistance at 94.69, the high of April 2, and support at 91.59, the low of April 19.

On Tuesday, the greenback sank versus the yen after downgrades of Greece and Portugal's credit ratings sparked fresh fears over euro zone sovereign debt.

But Germany's Finance Minister, Wolfgang Schaeuble, was quoted on Wednesday as saying the German cabinet could reach a decision to back financial aid for Greece next Monday, somewhat easing fears over the country's debt crisis.

The Japanese currency also slipped against the euro on Wednesday, with EUR/JPY rising 0.11% to reach 123.02.

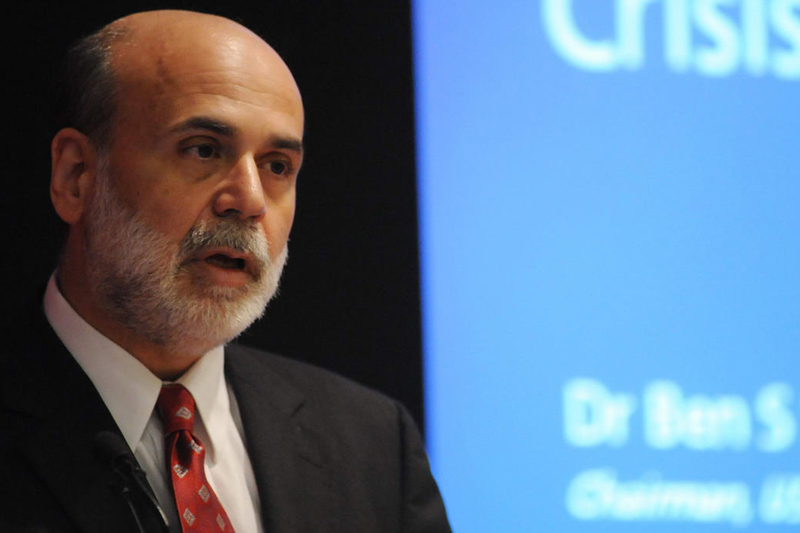

Later in the day, the U.S. Federal Reserve was set to announce a key interest rate decision and release a statement from its Federal Open Market Committee, which traders were likely to scrutinize for clues to future shifts in monetary policy.

USD/JPY hit 93.28 during European morning trade, gaining 0.03%. The pair was likely to find resistance at 94.69, the high of April 2, and support at 91.59, the low of April 19.

On Tuesday, the greenback sank versus the yen after downgrades of Greece and Portugal's credit ratings sparked fresh fears over euro zone sovereign debt.

But Germany's Finance Minister, Wolfgang Schaeuble, was quoted on Wednesday as saying the German cabinet could reach a decision to back financial aid for Greece next Monday, somewhat easing fears over the country's debt crisis.

The Japanese currency also slipped against the euro on Wednesday, with EUR/JPY rising 0.11% to reach 123.02.

Later in the day, the U.S. Federal Reserve was set to announce a key interest rate decision and release a statement from its Federal Open Market Committee, which traders were likely to scrutinize for clues to future shifts in monetary policy.