By Junko Fujita and Kane Wu

TOKYO/HONG KONG (Reuters) - Anbang Insurance Group Co Ltd [ANBANG.UL] aims to sell $200 million worth of Japanese real estate to bidders including Blackstone Group LP (N:BX), about two years after buying them from the U.S. investment firm, two people with knowledge of the matter said.

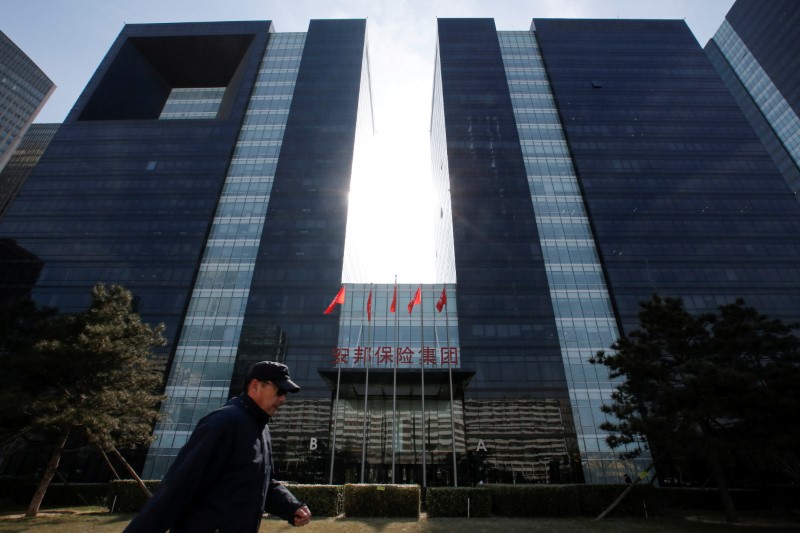

The debt-laden Chinese insurer, which was taken under the government control in February after spending more than $30 billion on acquisitions in recent years, is selling a portion of its Japanese residential assets to shore up its balance sheet, the people said.

The assets on sale are part of the portfolio of apartment buildings Anbang bought from Blackstone for around $2.3 billion, in its first foray into Japan's real estate sector.

A spokesman for Anbang declined to provide immediate comment, while Blackstone declined to comment.

The divestment comes as Anbang, which also owns New York's Waldorf Astoria hotel, is looking to offload $10 billion worth of overseas properties as part of a government-led restructuring effort.

China's government over the past year has sharpened its scrutiny of highly leveraged companies with overseas investments. Some conglomerates such as HNA Group Co Ltd [HNAIRC.UL] and Dalian Wanda Group Co Ltd have recently sold foreign real estate to pay down debt.

Anbang's Japanese real estate portfolio is scattered in major cities such as Tokyo, Osaka and Nagoya, said the people, who spoke on the condition that they not be identified as the deal process was not yet public.

The insurer wants to first sell assets deemed less attractive - mainly due to their location and age - as Japan's property market rebounds from a slowdown spanning the last three decades, one of the people said.

Japan's average residential land price is falling but the pace of decline has slowed, showed a government survey released last week.

Some potential bidders including Blackstone want Anbang to add more attractive assets to the portfolio on sale, the people said. If more assets are added, the sale could fetch about $500 million, they said.

The identity of other likely bidders was not immediately known, but a separate person said they include Hong Kong-based private equity firms.