By Aditya Soni

(Reuters) - Shares of Advanced Micro Devices (NASDAQ:AMD) Inc rose nearly 7% on Wednesday after the U.S. chipmaker's upbeat earnings showed that it was making up for a personal-computer slump with gains in the lucrative data center market.

At least 11 analysts lifted their ratings on the stock, cheering results that defied the "historic collapse" seen at rival Intel Corp (NASDAQ:INTC) and stoked expectations for further gains in the server market this year.

Lisa Su-led AMD on Tuesday posted quarterly revenue that beat Wall Street targets, but its sales forecast for the three months to March 31 fell short of estimates by over $150 million.

"While on an absolute basis results were not great, relative to their larger competitor's report last week the print came across much better," Bernstein analysts said in a note.

"Intel appears to be affected in a much worse way."

AMD's data center business revenue grew 42% in the quarter, compared with the 33% decline recorded at Intel's data center and artificial intelligence unit in the same period.

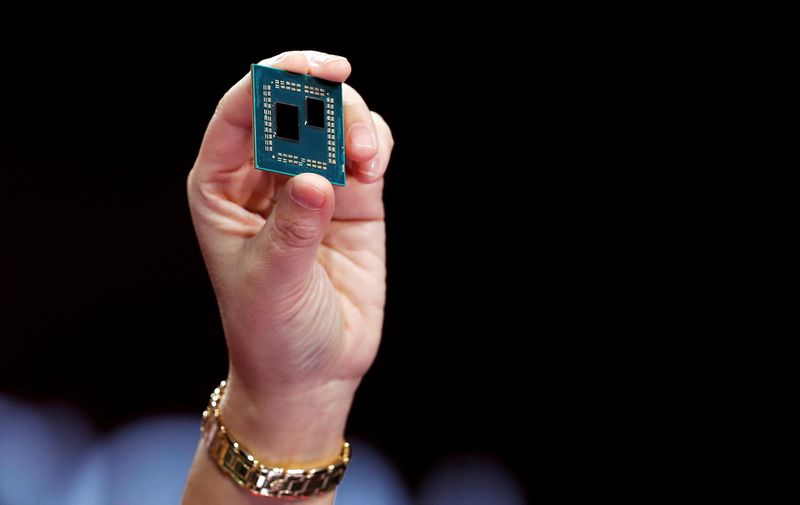

The data center market has slowed in recent months due to lower spending from recession-wary businesses, but AMD's faster and smaller chips have allowed it to gain ground on Intel.

"AMD can continue to beat Intel in the data center space due to its leading design," said Lucas Keh, semiconductors analyst at Third Bridge.

J.P. Morgan pegged AMD's share gain in the server market this year at 5 to 7 percentage points to between 28% and 30%.

The company, which started under-shipping PC chips last year in response to plummeting processor demand, said sales at the business that includes its PC chip unit fell 51% in the quarter.

"First quarter should be the bottom for us in PCs and then grow from there into the second quarter and then into the second half," Su said.