Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

By Dhirendra Tripathi

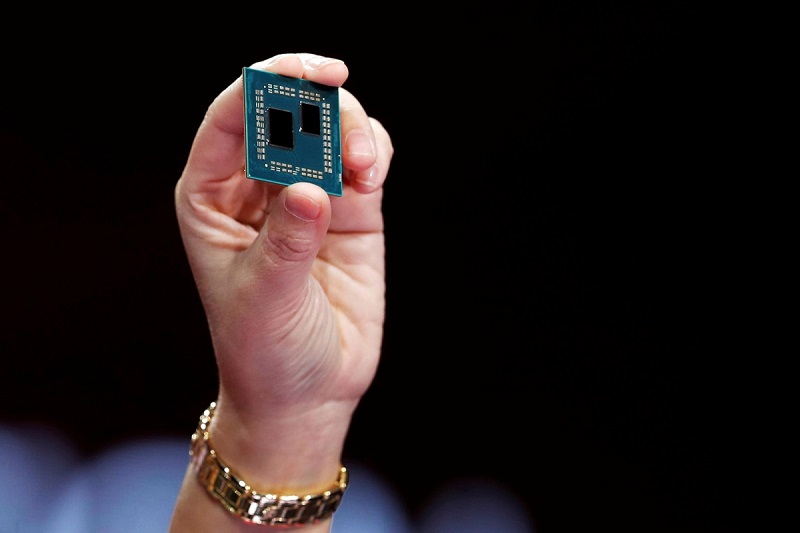

Investing.com – AMD stock (NASDAQ:AMD) stock surged 11.2% in premarket trading Wednesday after a strong annual revenue forecast, built on strong demand for its server chips.

For the full year 2022, AMD expects revenue to touch nearly $21.5 billion, a rise of 31%. Less than half of the 68% growth in 2021, the outlook still reflects solid momentum at the chip-making firm that just five years back trailed Intel (NASDAQ:INTC) by a wide margin on most parameters.

It's expecting 2022 gross margin to be 51%, higher by 3 percentage points from a year ago at a time when most feel chipmakers have already squeezed out the most in operating efficiencies.

AMD’s fourth-quarter revenue jumped 49% to $4.8 billion, a record driven by demand from Cloud customers.

Revenue at AMD’s enterprise, embedded and semi-custom unit rose 75%. The company attributed this to strong demand from makers of gaming consoles, an emerging business for the company where it competes with Nvidia's (NASDAQ:NVDA).

Computing and graphics segment reported a 32% jump in revenue on higher average selling prices for chips and strong demand for premium desktop and notebook PCs built with its Ryzen 5000 processors.

Adjusted profit per share was 92 cents, up 72%.

For the ongoing quarter, the company is projecting revenue of around $5 billion at the midpoint of its guidance range with gross margin at around 50.5%, 1.5 percentage points lower than's Intel's forecast.