(Reuters) -Albemarle, the world's largest lithium producer, aims to close its buyout of junior Australian rival Liontown Resources by the middle of 2024, its chief executive said on Tuesday.

Albemarle (NYSE:ALB) earlier this week made a revised, non-binding $4.3 billion bid for Liontown as it looks to lock down additional supplies of the key electric vehicle battery metal. The offer is part of a surge of interest in Australian lithium assets amid the clean energy transition.

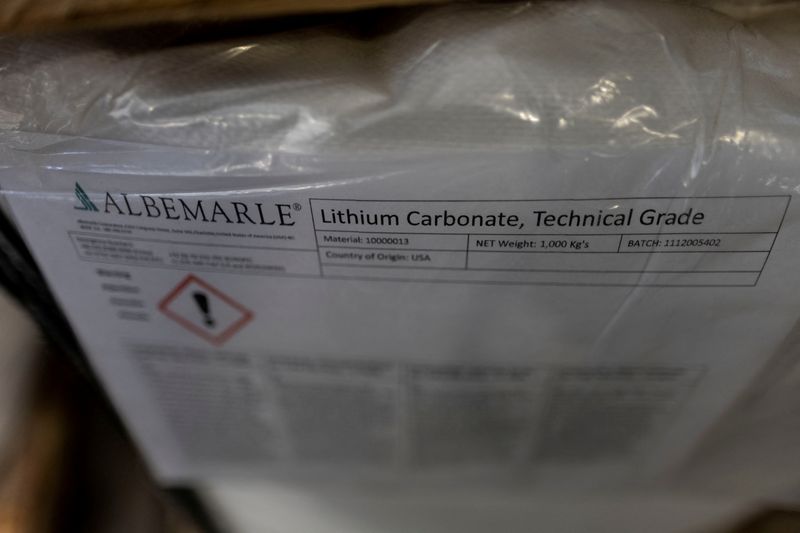

North Carolina-based Albemarle is already a major miner and processor of the battery metal in Australia, and the proposed deal is widely seen as a move to cement that dominance.

For Albemarle, Liontown and its Kathleen Valley lithium deposit would "increase our opportunity to meet rapid and growing lithium demand," CEO Kent Masters said on a Tuesday call with investors.

"What makes it a world class asset is the quality, the size and the fact that it's in Western Australia."

The deal is non-binding and still must be formalized and approved by shareholders. Liontown has agreed to let Albemarle look at some of its private records as part of a due diligence process that will also include a review of Liontown's agreement to supply lithium to Ford (NYSE:F), Tesla (NASDAQ:TSLA) and others through 2030.

"That's one part of due diligence, to go and understand those contracts," Masters said.

Masters and other Albemarle executives said that if the Liontown deal closes, the company likely would have to build processing facilities for the Kathleen Valley mine, which is expected to start producing 320,000 metric tons of lithium spodumene concentrate next year, with the potential to hit 700,000 metric tons per year by 2030.

Albemarle's shares fell 1% to $197.99 in premarket trading.