Investing.com - Here are the top five things you need to know in financial markets on Monday, July 17:

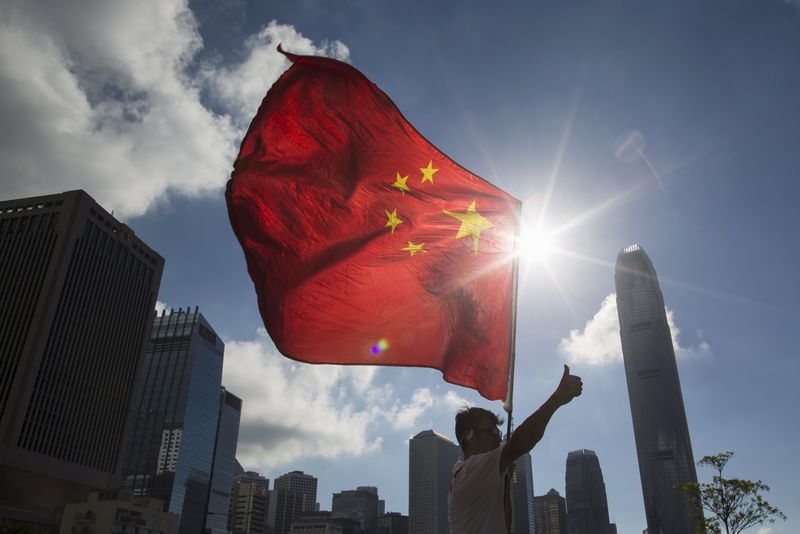

1. China growth data tops expectations

China's second quarter gross domestic product handily topped forecasts, while retail sales and industrial output were both strong.

The economy grew 6.9% in the three months to June 30, the same rate as the first quarter, the National Bureau of Statistics said. Analysts had expected the economy to expand 6.8% in the April-June quarter.

China's factory output grew 7.6% in June from a year earlier, the fastest pace in three months, while fixed-asset investment expanded 8.6% in the first six months of the year, both beating forecasts.

Retail sales rose 11.0% in June from a year earlier, the fastest pace since December 2015 and beating analysts' expectations for a 10.6%.

The upbeat data puts the Asian nation on course to comfortably meet its 2017 growth target, while giving policymakers room to tackle big economic challenges ahead of key leadership changes later this year.

2. Global stocks hold near record highs

Global stock markets held near record highs, as investors cheered upbeat Chinese data by piling into leveraged positions.

Asia shares hit a 2-year high overnight, but shares in mainland China ended lower amid concerns over the implications of a weekend meeting where President Xi Jinping said the central bank would play a greater role in defending against risks.

In Europe, markets nudged higher, with shares nearing a three-week high, as miners led gains.

On Wall Street, U.S. futures pointed to a flat open as a busy few weeks of earnings reports gets underway. BlackRock (NYSE:BLK) is slated to report results ahead of the opening bell, while Netflix (NASDAQ:NFLX) is due after the close.

3. Dollar sinks to lowest since September

The U.S. dollar and yields on U.S. government debt struggled near recent lows as investors wagered that lackluster U.S. data will keep the Federal Reserve cautious about the future pace of policy tightening.

The dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, fell to a 10-month low of 94.86 in overnight trade. It was last at 95.00 in early U.S. trade.

Meanwhile, yields of the benchmark 10-year U.S. Treasury dipped to around 2.31%, remaining well-off highs near 2.39% touched earlier this month.

Futures traders are pricing in less than a 40% chance of a rate hike by the end of the year, according to Investing.com’s Fed Rate Monitor Tool, down from around 50% a week earlier.

Investors will also be looking out for the Empire State Manufacturing survey, slated to come out at 8.30AM ET (12:30GMT).

4. Cryptocurrencies recover from weekend slide

Prices of Bitcoin and Ethereum halted their recent decline, bouncing back after suffering heavy losses over the weekend on the back of worries over a cryptocurrency bubble.

Bitcoin was at $2,061.90 on the U.S.-based GDAX exchange operated by Coinbase, up about 7.5%, or $143.40.

The cryptocurrency plunged about 13% on Sunday from above $2,000 to as low as $1,758.20, a level not seen since May 16, as investors remained wary of initiating large positions amid growing concern over the future of the digital coin.

Ethereum, Bitcoin's closest rival in terms of market cap, was up 15.2%, or $23.70, to $179.64. It dropped by more than 20% on Sunday to $130.26, its lowest level in more than a month.

Prices are down almost 55% since peaking at an all-time high close to the $400-level in mid-June, but still up about 1,800% year-to-date.

5. Second round of Brexit talks kick off

U.K. Brexit Secretary David Davis meets the European Union's Michel Barnier for four days of talks between their teams in Brussels, as a second round of negotiations on Britain's withdrawal from the EU gets underway.

Working groups will focus on three areas: citizens' rights; the EU demand that Britain pays some 60 billion euros ($69 billion) to cover ongoing EU budget commitments; and other loose ends, such as what happens to British goods in EU shops on Brexit Day.

A month after their first meeting, the Frenchman will press Davis to agree to Britain covering substantial British financial commitments and offer more detail on other British proposals.