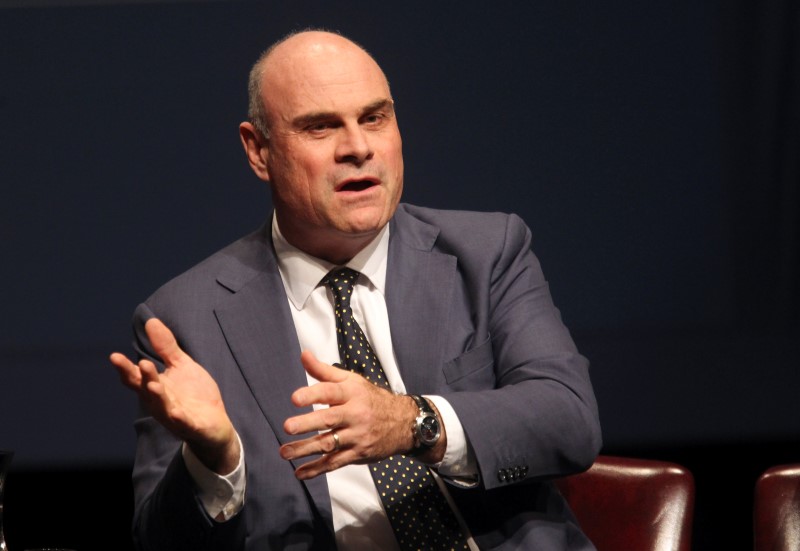

(Reuters) - Breaking up American International Group Inc (N:AIG) does not "make financial sense" Chief Executive Peter Hancock said on Tuesday, responding to proposals made by billionaire investor Carl Icahn last week.

Icahn, in one of the largest activist campaigns of the year, wrote to Hancock urging to him to spin off AIG's life and mortgage units into public companies, cut costs more aggressively and give back more to shareholders.

The move would return more cash to shareholders, Icahn had said, and help AIG rid itself of the regulatory burden of being a systemically important financial institution (SIFI), which require higher capital cushions.

AIG shares, which had gained 4.6 percent since Icahn's proposal on Wednesday, were down nearly 5 percent on Tuesday, hurt partly by a slump in third-quarter operating profit.

"A separation would result in less capital being available for distribution," Hancock said on a conference call to discuss AIG's results.

Since 2012, AIG has returned over $26 billion to shareholders through share buybacks.

A split would also drive up certain expenses and distract the company from cost-cutting, he added, saying the amount AIG spent on SIFI compliance was a fraction of its total regulatory compliance costs around the world.

"We, of course, will meet with (Icahn) to further share our conclusions and give him an opportunity to elaborate on his views," Hancock said.

He told CNBC he plans to meet with Icahn on Thursday. He also said a break up would not be tax-friendly.

AIG is taxed as a life and non-life insurer, which allows it foreign tax credits. Hancock had said in a letter to shareholders in 2014 that changes to this structure would mean forfeiting "significant economic benefit".

Icahn said last week that he had a built up a "large stake" in AIG. The activist investor's stake is around 2 percent, according to Bloomberg.

AIG reported on Monday that quarterly operating profit plunged 60 percent as income at all but one of its underwriting businesses declined and tumultuous markets hurt its investments.

The stock was down 4.7 percent at $60.76 in morning trading.