By Suzanne Barlyn

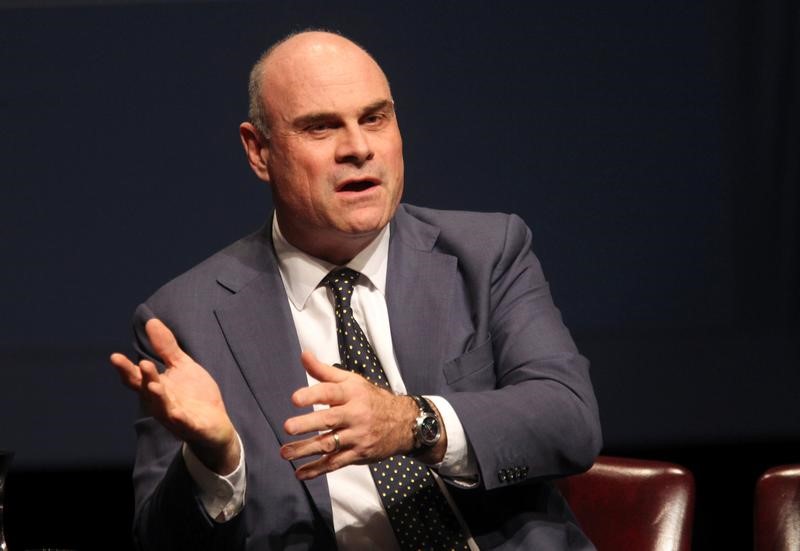

(Reuters) - American International Group Inc's (N:AIG) board of directors declined to award Chief Executive Officer Peter Hancock a cash bonus for his work last year, after the company's dismal financial performance roiled shareholders, according to a proxy filing on Thursday.

Hancock did, however, receive his $1.6 million base salary and longer-term incentive pay in stock worth more than $8.2 million that will start to pay out in 2019.

The insurance company's board has also re-nominated Samuel Merksamer, who represents billionaire Carl Icahn, to serve on the board for another term. Merksamer, who exited the activist investor's firm, Icahn Capital, a unit of Icahn Enterprises LP, last year, would continue as Icahn's representative, according to the proxy filing.

AIG’s proxy filing comes at a tumultuous time for the U.S. insurance company. Last month, AIG announced that Hancock, 58, would step down, after a poor fourth quarter frustrated shareholders and the insurer's board of directors. Hancock will stay on as chief executive until the board finds a successor, the company has said.

Icahn, AIG's fourth-largest investor, began acquiring his stake in the insurance firm in 2015. He advocated splitting up AIG into three parts. The insurer instead embarked on a two-year turnaround plan developed by Hancock, which intended to return $25 billion to shareholders. Last year, AIG returned a total of $13.1 billion of capital to shareholders, the company said.