(Reuters) - Budweiser beer maker Anheuser-Busch InBev (BR:ABI) has started searching for a replacement for its long-serving chief executive Carlos Brito, the Financial Times reported https://www.ft.com/content/101049df-27ee-4362-973e-b763a05dd7b6 on Monday.

The world's biggest brewer is considering external candidates to replace Brito, who has been its CEO for 16 years and has overseen a string of mergers that transformed two Brazilian and Belgium drink-makers into a global giant, the FT reported, citing people with knowledge of the matter.

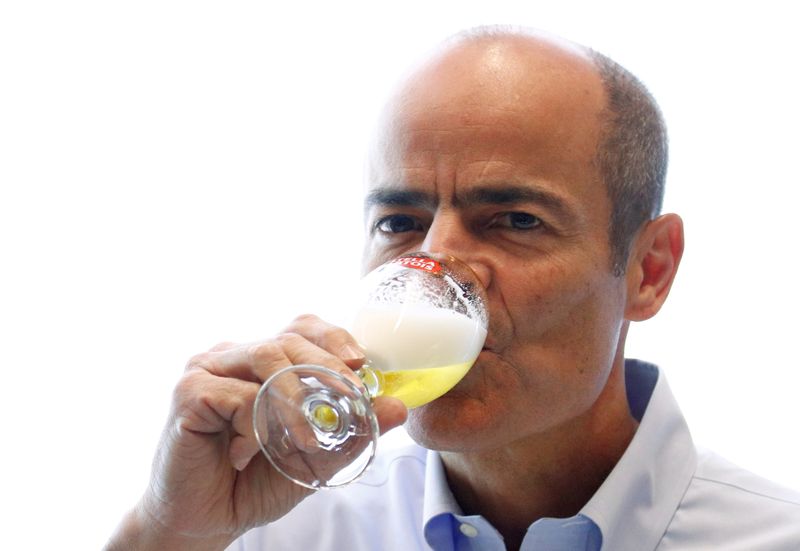

AB InBev declined to comment on the FT report, which also said that the company is currently considering only one internal candidate, Michel Doukeris, who heads its North America-based Anheuser-Busch business.

Brito is involved with the board in the process and plans to step down at some point next year, the FT said, citing one person. It is also possible that Brito remains in charge for longer if a replacement is not found, it said, added that Brito was expected to join AB InBev's board after stepping down.

Bernstein Research said in a note that the timing of the leadership change made sense, with the COVID-19 crisis potentially abating and the company needing to shift focus to more internal growth after years of acquisition-led expansion.

It said it also made sense to look outside the company, but it was most likely that an internal candidate would prevail, with Doukeris the clear frontrunner.

AB InBev, which makes Stella Artois and Corona, is working with recruitment firm Spencer Stuart on the search, the FT said.

Brazilian-born Brito's biggest deal to date was the near-$100 billion takeover in 2016 of its nearest rival SABMiller (LON:SAB), whose business in Africa plugged a critical hole in the company's global footprint.

However, AB InBev's shares are currently trading 60% below their all-time high of 2015, partly due to concerns over the deal-related debt, which was at a net $87.4 billion at the end of June.

In response, the company has halved its final 2019 dividend and sold assets, including its Australian business to Japan's Asahi (T:2502).