The stock market has been fairly placid lately, and many investors are attempting to anticipate its next strong move.

Add in the guess from the equity strategy team at HSBC, who said in a note Thursday that the market won't stay quiet for long and there is a strong case for the next move to be in a downward direction.

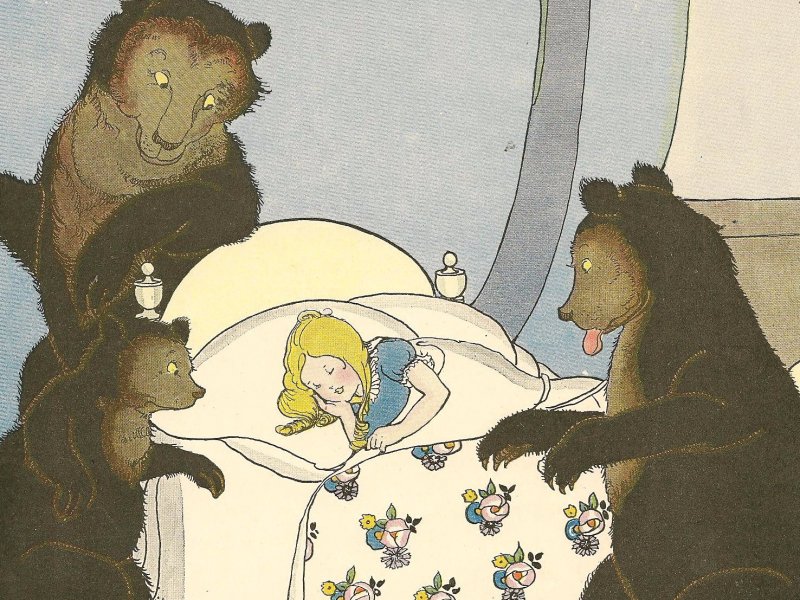

Ben Laidler and Daniel Grosvenor at HSBC said that the stock market has undergone a "Goldilocks" rally of late and there are "three bears" that are waiting in the wings to undercut the higher index levels in markets.

Admittedly, it's a cheesy metaphor but Laidler and Grosvenor's "three bears" are:

- Policy uncertainty undermining earnings growth. Much of the enthusiasm for stocks, according to the HSBC strategists, is due to a possible recovery in corporate earnings growth which has been in a recession. Due to policy uncertainty and lackluster GDP growth, the strategist said that earnings growth is likely to underperform expectations, disappointing investors.

- Stretched valuations retreating to their long-term averages. The strategist note that the MSCI All-World Index was a price-to-earnings (P/E) multiple of 15.8x, which is right around its 10-year high. Additionally, forward-looking P/E multiples are lower, but only due to an earnings recovery Laidler and Grosvenor do not expect to materialize. "You have to be relatively optimistic on the outlook for earnings to argue equities are cheap compared to history," said the strategists.

- Sentiment isn't supportive. Typically, sentiment as seen as a contrary indicator. Recovery from downtrodden sentiment usually helps take stocks higher. "At a broader level, the HSBC Sentiment Index shows overall investor sentiment as close to average, rather than depressed," said the note. Thus, there isn't reason to believe a buying frenzy can help boost the market.

Laidler and Grosvenor don't think that these three factors will lead to the markets getting destroyed, but it will certainly lead to a drop.

"As with the fairy tale itself, we do believe in benign endings," said the strategists. "We are worried about a correction, not a crash. We are not advising to '…sell the kids.' We think we are in fundamentally range-bound markets, with low growth and low bond yields, but that the top of this range has been overshot."

The strategist say that the correction isn't something to be overly concerned about — there have been eight corrections of 9% or more since 2008 — but investors should be ready for it when it comes.