by Marco Oehrl and Robert Zach

Investing.com - Sooner or later, there will be no way around switching from a combustion engine to an electric vehicle. This is no longer just the view of politicians, but also of the stock market. This can be seen in the KraneShares Electric Vehicles and Future Mobility Index (NYSE:KARS), which lists companies such as the largest Chinese manufacturer of lithium-ion batteries Contemporary Amperex Technology Co Ltd Class A (SZ:300750) or the Japanese manufacturer of electric motors Nidec Corp (T:6594), as well as the American electric car manufacturer Tesla (NASDAQ:TSLA), in its list of holdings and has been able to gain 25 percent this year despite sometimes violent price fluctuations.

But that is in the past. What counts now is the future. Which of the manufacturers will be ahead in the next twelve months and which e-mobility stocks can benefit most from this megatrend?

E-Cars - The Future Of Transportation

Registration of new electric vehicles seems to be stagnating in some regions of the world, but in Europe, e-mobility is being pushed forward with vigor. In Brussels, people are aware that this is a must to achieve ambitious climate targets.

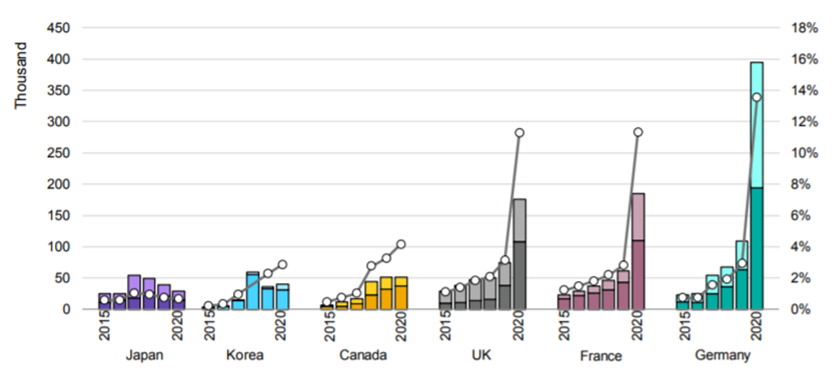

Alongside the UK and France, Germany is the main driver behind this current development. As early as 2020, sales of plug-in hybrids and pure electric vehicles in the German market reached almost 16 percent market share.

See image in top of article. Source: IEA Global EV Outlook 2021

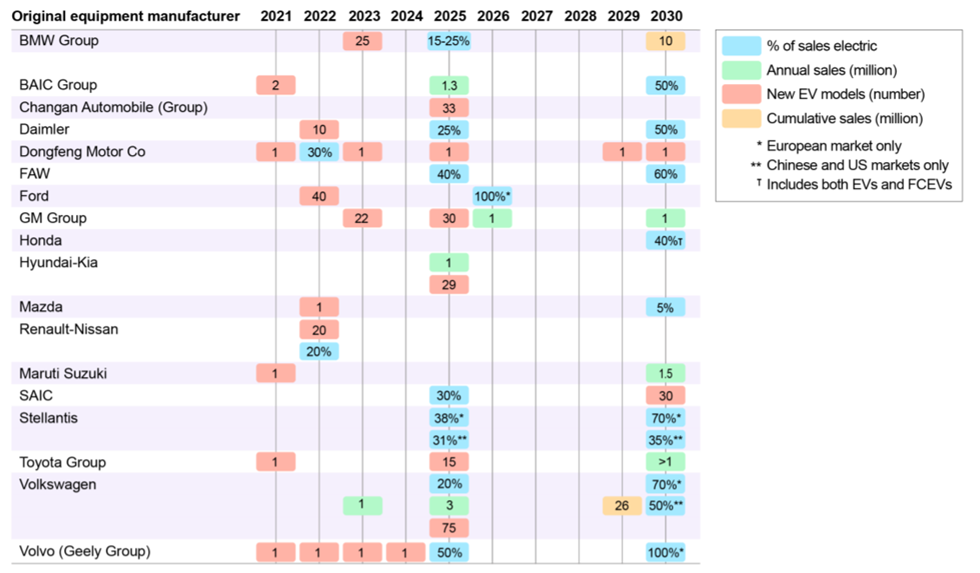

However, the level of commitment from the different vehicle manufacturers to shift to electric vehicle production is varied, which is ultimately also related to the legal framework conditions in the respective target markets.

If a manufacturer fails to comply with the specified limits for CO₂ emissions, they either have to purchase expensive CO₂ certificates to compensate or pay penalties.

See image in top of article. Source: IEA Global EV Outlook 2021

Among the long-established manufacturers, Volvo AB ADR (OTC:VLVLY) (50 percent), Faw Car Co Ltd (SZ:000800) (40 percent) and SAIC Motor Corp Ltd (SS:600104) (30 percent) are targeting the largest share of electric cars in terms of total vehicle sales by 2025.

This rapid development will lead to tougher competition for the newcomers (Tesla, Nio (NYSE:NIO), & co.) in the automotive sector that are relying on purely electric drives.

In the long term, it will probably not be easy for them to convince Generation X and Millennials, who have already built up brand loyalty to the Teslas of the world, to switch to “legacy” brands. Especially given how loyal they are to their beloved cars and how used they are already to planning their next road trip based on the availability of charging stations.

Either way, the car of the future is electric, as several countries have already decided by law that the transportation sector must be converted to a CO₂-neutral variant.

Norway is the clear front-runner in this respect, as the country is committed to achieving this goal as early as 2025. This means that passenger car manufacturers who want to continue to exist in this market are forced to act accordingly. The fact that Norway is on the path to achieving this goal is shown by the fact that the 11,274 electric passenger cars newly registered in November already accounted for 73.8 percent of total sales.

In The Haze Of E-Mobility

The transformation of the automotive industry has set an avalanche rolling that will also help some other industries to achieve exorbitant growth. And that's regardless of whether Tesla or the long-established manufacturers emerge victorious from the transformation.

The basic material from which the CO₂-neutral dreams are made is lithium, because without this raw material there would be no lithium batteries, which are found in almost every electric vehicle. The electric motors themselves, in turn, consist of a significant amount of copper, and semiconductors are again needed for operation and communication between the technical components.

Then, of course, there is electricity, without which no electric car would budge even an inch. Not to mention the charging stations, which should ideally be available in sufficient numbers throughout the country.

The latter is of particular importance if we want to avoid the warnings from ADAC, Europe’s largest motoring association, of waiting at too few charging stations during the coming vacation travel waves. Or rows and rows of empty batteries weighing tons having to be collected by tow trucks on the highways.

Just a few days ago, Enbw (DE:EBKG) opened Germany's largest fast-charging station to date at the Kamener Kreuz interchange, where up to 52 electric cars can be recharged for the onward journey.

It is hubs like this that need to be set up in the shortest possible time so that drivers no longer base their purchase decision solely on battery range. With a conventional combustion engine, no one asks how far you can get on a tank of gas because gasoline is available on every corner.

Corporations like EnBW have recognized this, and it is no longer a question of operating the charging stations economically from the outset. The goal is to cherry-pick the busy routes and earn money from the new trend in the long term.

So let's take a look at the fifteen e-mobility stocks that Wall Street analysts believe have the greatest upside potential over the next twelve months.

Investing.com used our stock screener for this, filtering for stocks from the e-mobility sector that are followed by at least five analysts and have at least five buy recommendations and where there is the greatest upside potential. To make the list, the stocks had to have a market capitalization of at least $5 billion. The list includes companies from the traditional automotive industry such as manufacturers and suppliers, the semiconductor industry, as well as charging station operators that can benefit from the electric mobility trend:

-

ChargePoint Holdings Inc (NYSE:CHPT) (average price target in 12M: $31.56 / +62.69%)

-

Plug Power (NASDAQ:PLUG) (average target price in 12M: $49.22 / +58.77%)

-

Li Auto Inc (NASDAQ:LI) (average target price in 12M: $44.40 / +46.81%)

-

Xpeng Inc (NYSE:XPEV) (average target price in 12M: $59.81 / +40.53%)

-

Fisker Inc (NYSE:FSR) (average target price in 12M: $24.73 / +39.31%)

-

Daimler (OTC:DDAIF) (average target price in 12M: 99.39 EUR / +38.54%)

-

Vontier Corp (NYSE:VNT) (average target price in 12M: $42.67 / +37.32%)

-

Stellantis NV (NYSE:STLA) (average target price in 12M: 22.10 EUR / +31%)

-

Cummins (NYSE:CMI) (average target price in 12M: $276.77 / +26.25%)

-

Magna International (NYSE:MGA) (average target price in 12M: $97.82 / +24.66%)

-

Honda Motor Co Ltd ADR (NYSE:HMC) (average target price in 12M: JPY 3,983.7 / +24.37%)

-

SolarEdge Technologies (NASDAQ:SEDG) (average target price in 12M: $369.05 / +21.81%)

-

General Motors (NYSE:GM) (average target price in 12M: $3,983.7 / +21.49%)

-

Analog Devices (NASDAQ:ADI) (average target price in 12M: $369.05 / +19.39%)

-

BMW (DE:BMWG) (average target price in 12M: 106.98 EUR / +19.34%)

Note: All calculations refer to the respective closing price on December 15, 2021.

ChargePoint Holds The Highest Charge

Analysts see the greatest share price potential in charging infrastructure provider ChargePoint. On average, the 16 experts surveyed by Investing.com predict a potential return of 62.69 percent for the CHPT share price in the next 12 months. Of those, 10 advise buying and 6 advise holding, with no sell recommendations. The average target price for ChargePoint stock is $31.56.

The facts: ChargePoint is the largest among the publicly traded charging specialists, which also include EVgo, Blink Charging and Volta, and at the same time currently the cheapest, considering its forward EV-to-Sales ratio, which is just 24.5x, according to InvestingPRO, while Blink Charging, EVgo and Volta come in at 50.9x, 56.8x and 33.1x, respectively.

Recently, however, ChargePoint shares came under pressure after the company presented its quarterly results. While the company raised its revenue guidance, it reported an unexpectedly large loss for the third quarter. Still, the bulk of the numbers speak for themselves: Revenue for the quarter rose 79 percent to $65 million, at the high end of the company's guidance. Adjusted gross margin for the period was 27 percent, up from 20 percent in the year-ago period. As of Oct. 31, ChargePoint had about 163,000 charging points in operation, including about 45,000 in Europe. Through roaming agreements, customers can also charge their vehicles at more than 290,000 stations operated by other providers. ChargePoint expects revenue of $73 million to $78 million for the final quarter ending Jan. 31, 2022, and raised its full-year revenue guidance, also ending Jan. 31, 2022, to $235 million to $240 million from $225 million to $235 million.

If the mobility revolution is really to succeed, it needs a functioning charging network. Having the market leader in the depot is probably not the worst idea, especially since the Biden administration wants to have at least 500,000 charging stations installed by 2030, as stated in the current EV Charging Action Plan in the U.S., which totals an investment volume of $7.5 billion.

"The future of mobility in our country and around the world is electric," Vice President Kamala Harris recently told the Associated Press at an electric vehicle charging station in suburban Maryland.

Plug Power Seen As Having High Upside

The next stock Wall Street sees as having great potential over the next 12 months is Plug Power, a maker of fuel cell engines for e-mobility and the associated hydrogen infrastructure that enables green, sustainable energy for businesses. The average price targets of the 24 analysts surveyed by Investing.com indicate a potential upside of 58.77 percent. The target price is $49.22.

As recently as mid-November, Morgan Stanley raised its price target for PLUG shares from $43 to $65, citing a much better electrolyzer and hydrogen production business.

"We are raising our revenue estimates significantly, particularly for electrolyzers (+131 percent) and hydrogen production (+86 percent), driven by management's comments on the growth of these businesses over the next several years. This leads to a 51 percent increase in our price target to $65, a 61 percent increase from current price levels," Morgan Stanley’s analysts said.

The U.S. infrastructure bill also plays an important role for Plug Power, with $8 billion earmarked for the development of regional clean hydrogen centers. That includes $500 million for clean hydrogen production and $1 billion to reduce the cost of producing clean hydrogen with electrolyzers.

According to McKinsey, the industry remains in its infancy. According to one study, total investment in hydrogen projects and along the entire value chain is expected to reach an estimated $500 billion by 2030. The basis for this is electrolyzers, i.e. devices in which hydrogen and oxygen are decomposed with the aid of electric current to produce hydrogen. This is then stored and used as final energy in a variety of applications. It is precisely in this area that Plug Power is a leader, which makes the stock still interesting despite the recent volatility in this sector.

Li Auto Offers A China-Based EV Play

The return potential of Chinese e-car manufacturer Li Auto should not be neglected either. Analysts see a price appreciation potential of almost 47 percent for the company, which was founded in 2015 and is in direct competition with Tesla and Nio.

The average price target of 20 analyst estimates is $44.40. The company unveiled its first and so far only model, an electric hybrid SUV called Li ONE, in December 2019, but it received an update in May this year. The vehicle is priced between $29,000 and $76,000, depending on features. In 2020, it was among the top ten best-selling vehicles in China across all fuel types. Li Auto set another monthly delivery record as recently as November. The Chinese electric car maker reported a total of 13,485 Li ONEs delivered last month. This represents an increase of 190 percent compared to the same month last year. By comparison, Nio sold only 10,705 cars in the same period, while Xpeng (NYSE:XPEV) came in at 15,613. Li Auto's total deliveries so far this year stand at 76,404.

In the third quarter, Li Auto increased its revenue to $1.2 billion, up nearly 230 percent from the same quarter last year. Li Auto's sales growth in the third quarter was even higher than that of rival companies Xpeng and Nio.

For the fourth quarter, Li Auto expects to sell 30,000 to 32,000 cars. That would be a year-on-year increase of more than 100 percent. The company's Changzhou production facility has an annual production capacity of 100,000 units, but can be expanded to 200,000 units.

And valuation-wise, Li Auto (6.1x) is also cheaper than its peers Nio (7.8x) and Xpeng (10.3x) based on forward EV-to-sales ratio, according to InvestingPRO data.

In the long run, Li Auto should continue to benefit from strong growth in domestic demand for e-cars. The Chinese electric vehicle market was valued at $98 billion in 2019 and is expected to register a compound annual growth rate ("CAGR") of 31 percent over the forecast period (2021 - 2026), according to Mordor Intelligence.

Overall, Li Auto's stock certainly looks promising and definitely belongs on the watchlist for all investors who are concerned with electric mobility and are looking for a low-cost alternative to Nio or Tesla.

Alternatives: Other companies in the e-mobility sector that are also seen as having greater upside potential by analysts over a 12-month period are: BYD Co (OTC:BYDDF) Ltd Class A (SZ:002594) (+17.37%), BorgWarner (NYSE:BWA) (+16.87%), and NVIDIA (NASDAQ:NVDA) (+15.5%).

Read also: 3 Cutting-Edge Investment Themes To Watch For In 2022

Check out our full 2022 outlook series here.