By Pete Schroeder and Katanga Johnson

WASHINGTON (Reuters) - Influential liberal think tanks are starting to identify Wall Street-friendly rule changes made by the Trump administration that could be scrapped using the Congressional Review Act if presidential candidate Joe Biden wins the White House and Democrats retake the Senate on Nov. 3.

Here are some likely candidates.

COMMUNITY REINVESTMENT ACT OVERHAUL

In May, the Office of the Comptroller of the Currency updated the Community Reinvestment Act, a 1977 fair-lending law that encourages banks to invest in low-income communities, to account for technological changes in the way banks do business.

Democrats slammed the changes, which they said would make it easier for banks to earn passing grades while doing less.

VOLCKER RULE 'COVERED FUND' CHANGES

In June, bank regulators loosened a "Volcker Rule" provision on bank investments to make it easier for large lenders to take stakes in venture capital funds and other vehicles. Banks said this "covered funds" provision was far too aggressive, often sucking in overseas firms with little to no U.S. presence.

Created after the 2009 financial crisis, the Volcker Rule is seen as a sacred safety and soundness tool by Democrats who say the changes could reopen the door to casino banking.

'INTER-AFFILATE,' OTHER SWAP RULES

The "inter-affiliate" rule change was one of the biggest victories for Wall Street banks under the Trump administration. After years of lobbying, banks convinced regulators to kill the post-2009 crisis requirement for big banks to hold capital against swap trades between units of the same bank holding company. Finalized in June, the change was due to free roughly $40 billion for big banks, according to industry estimates.

Other swap rules potentially on the chopping block include a July decision https://www.cftc.gov/PressRoom/PressReleases/8211-20 by the Commodity Futures Trading Commission to relax swap hedging safeguards and swap capital cushion calculations.

Regulators say the changes aim to reduce overlapping or burdensome requirements. Critics say they increase risks in the swap market, which exacerbated the 2009 crisis.

SHAREHOLDER VOTING, DISCLOSURES

In July, the Securities and Exchange Commission placed new restrictions on companies that advise investors on how to vote in corporate elections after years of gripes from the business community that these advisors have too much power and too little oversight. Critics of the changes say they make it harder for investors to push corporations on social and environmental issues.

In May, the SEC also reduced corporate disclosure requirements around acquisitions and divestments to mitigate the burden for companies, but critics said the move would reduce transparency for investors https://tax.thomsonreuters.com/news/divided-sec-scales-back-disclosure-for-business-combination/].

'VALID WHEN MADE'

The Trump administration's July rule clarifies that a loan's original terms remain valid if it is transferred to a state with stricter lending rules. It was adopted to settle a court fight over whether a borrower could sue to challenge a loan that had been sold to a state that would never have allowed it in the first place.

Regulators said it provided much-needed clarity, but its opponents said it pre-empts state consumer protection laws and will boost predatory lending.

PAYDAY LENDING

In July, Trump's Consumer Financial Protection Bureau (CFPB) rolled back a contentious Obama-era rule, which aimed to crackdown on payday lenders by requiring them to establish that a borrower had the means to repay.

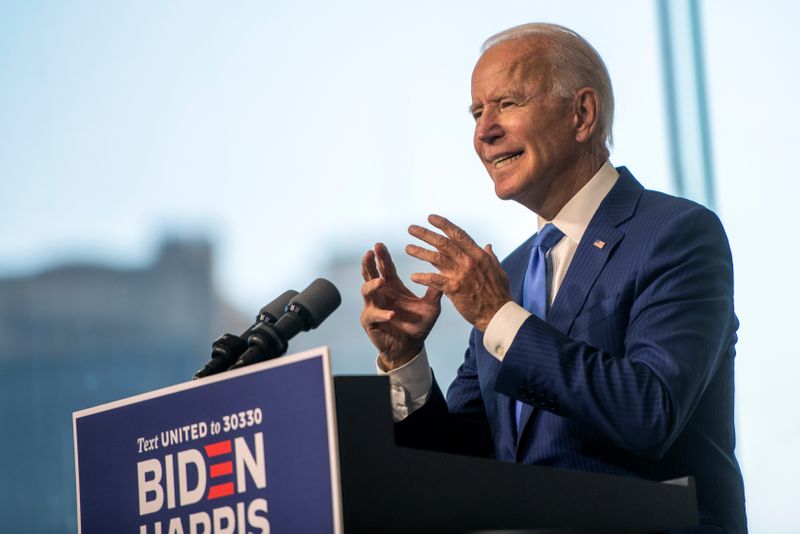

The industry fought the proposal, and the Trump administration stripped out the "ability-to-repay" provision. Democratic presidential nominee Joe Biden said at the time that the decision was “a windfall to predatory lenders."