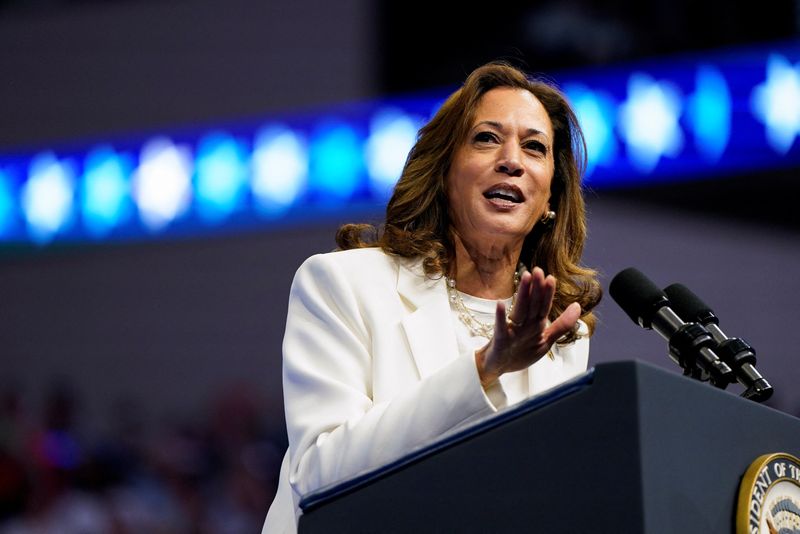

Investing.com -- According to a recent UBS survey, a majority of wealthy investors plan to support Vice President Kamala Harris in the upcoming U.S. presidential election.

The survey reveals that 57% of wealthy investors favor Harris, while 43% intend to vote for former President Donald Trump.

The poll, conducted among investors with at least $1 million in investable assets, also highlights a clear preference for Harris among Democrats, with 91% backing her compared to only 9% for Trump. Meanwhile, 88% of Republican investors favor Trump.

Among independents, Harris has a slight edge, with 60% indicating support for her compared to 40% for Trump.

The economy remains the most important issue for these investors, with 84% naming it as their top concern.

Other significant issues include Social Security (71%), immigration (68%), and taxes (69%). Investors are almost evenly split on who they believe is better equipped to handle the economy, with 51% siding with Trump and 49% with Harris.

Among business owners, a separate UBS survey shows that the majority prefer Trump, with 53% indicating they will vote for him compared to 47% for Harris.

Similar to the wealthy investor group, these business owners rank the economy as their top concern, followed by taxes, health care, Social Security, and immigration.

In terms of optimism, wealthy investors feel more positive about the U.S. economy and their portfolios than they did four years ago. For example, 55% of respondents expressed optimism about the U.S. economy in 2024, up from 43% in 2020.

Likewise, business owners report increased optimism, with 65% feeling confident about the U.S. economy, compared to 55% in 2020.

Both groups are preparing for potential changes, with 77% of wealthy investors considering adjustments to their portfolios before the election, up from 63% four years ago.

The most anticipated portfolio changes include adjusting sector allocations (38%), adding portfolio protections or hedges (35%), increasing investments (34%), and boosting cash holdings (34%), the UBS survey shows.