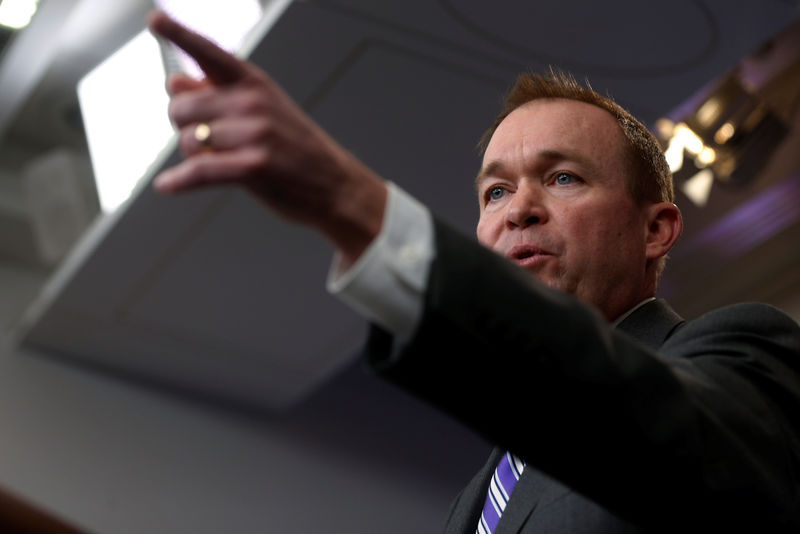

WASHINGTON (Reuters) - White House budget chief Mick Mulvaney said on Monday he expects the Treasury secretary to use extraordinary cash management measures after the government's current debt ceiling extension expires on March 15.

"The secretary of the Treasury actually makes the decision and I expect him to do what all previous secretaries of the Treasury have done, at least all the ones that I'm familiar with, to use those measures to extend that date," Mulvaney said in an interview on Fox News.

"But we will deal with it," he said, "certainly" before Congress recesses in August.

Treasury Secretary Steven Mnuchin said at his Senate confirmation hearing last month that he would like to see an increase in the debt ceiling "sooner rather than later" to avoid another standoff with Congress that could upset financial markets.

The United States is one of few nations in which the legislature must approve periodic increases in the legal limit on how much money the federal government can borrow. Rather than setting a specific dollar limit on the debt, Congress in 2015 simply suspended the ceiling until March 15, allowing normal borrowing to continue.

The debt ceiling will reset at the total debt level outstanding on that day, but Congress will need to approve a new debt ceiling or extension. As of Feb. 23, the federal debt stood at about $19.88 trillion, according to Treasury data.

But analysts estimate that Treasury can continue to borrow and avoid a payment default for several months past March 15 even with no action from Congress as it deploys its extraordinary cash management measures.

In the past, the Treasury has been able to stave off depletion of its cash reserves with steps such as temporarily halting investments in some pension funds for federal workers and suspending sales of certain securities to state and local governments.

Although such steps are known as "extraordinary measures," they are routinely used by Treasury during debt ceiling debates.

In 2011, Standard & Poor's downgraded the U.S. credit rating for the first time after a gridlocked Congress waited until the government was possibly within hours of defaulting on its debt to raise the ceiling.