By Chris Prentice

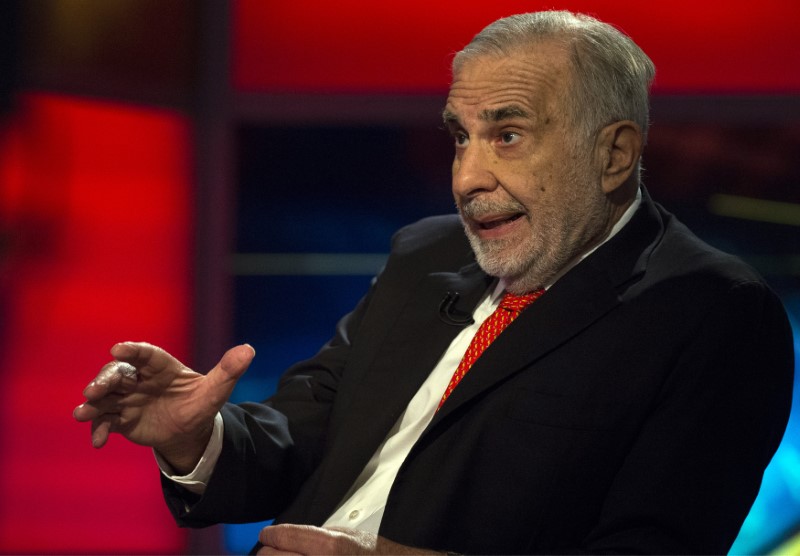

(Reuters) - A government watchdog group, Public Citizen, said on Wednesday it has asked lawmakers to investigate whether Carl Icahn violated lobbying disclosure laws, a complaint the billionaire investor denied and called a "witch hunt."

The group said Icahn may have been acting as a lobbyist when he advised President Donald Trump to overhaul the U.S. biofuels program. Icahn, an unpaid adviser to Trump on regulation, submitted a proposal to Trump last month to change the U.S. Renewable Fuel Standard by shifting the burden of blending biofuels into gasoline away from oil refining companies, and further down the supply chain to marketers.

Public Citizen said that, because Icahn owns a controlling stake in a refinery that could benefit from the proposed change, he may have been required by a 1995 lobbying disclosure law to disclose his discussions with Trump on the subject as lobbying. The group said it has made its request for a probe in a letter sent to Congress on Wednesday morning.

"All of this has occurred with no record of any (Lobbying Disclosure Act) filings by or on behalf of Mr. Icahn," Public Citizen said in a copy of the letter provided to Reuters.

Icahn did not respond to Reuters requests for comment but described the complaint in an opinion piece on The Hill website as a "gross misstatement of the facts" and said he had vetted his activities with lawyers.

'ETHICS ROCK AND A LOBBYING HARD PLACE'

The RFS, signed into law by former President George W. Bush, requires oil companies to mix increasing levels of renewable fuels into gasoline and diesel each year - a requirement that many refiners say costs them millions of dollars. Oil companies can either blend biofuels or buy paper credits, known as Renewable Identification Numbers (RIN), from those that have.

Icahn owns an 82-percent stake in refiner CVR Energy Inc (N:CVI), which along with other refining companies, has urged the Environmental Protection Agency (EPA) to shift the blending obligation away from them.

"While we are not fighting the Renewable Fuel Standard, I have for months and will continue to speak out against the misguided way in which the EPA has been administering the RFS" with regards to the agency's handling of a "corrupt" RIN market, Icahn said.

Efforts to reach the White House were not immediately successful.

"Carl Icahn is between an ethics rock and a lobbying hard place," said Norman Eisen, co-founder of Citizens for Responsibility and Ethics in Washington who served as the chief ethics lawyer for former President Barack Obama. "If he claims he is an informal advisor, then he is subject to lobbying rules."

Icahn has disclosed his role as a Trump adviser to the Securities and Exchange Commission, but he has not registered as a lobbyist. Several Democratic lawmakers have said they want more information about his role in the Trump administration.

Shares of CVR Energy jumped over 1 percent following Icahn's response but pared gains and was unchanged at $21.40 by 3:47 p.m. EST (2047 GMT). Share values have risen about 70 percent since the presidential election. Over that time, Icahn's stake has gained over $600 million in value, according to Reuters data.

Last week, the head of a U.S. biofuels group said Icahn told him that Trump was readying an executive order to change the point of obligation for blending under the biofuels program, something both the White House and Icahn have denied.

The White House has said it is reviewing Icahn's proposal and has not yet taken a position.