WASHINGTON (Reuters) - Two U.S. senators from Midwestern states will introduce a bill on Tuesday that would require foreign companies buying U.S. food and agriculture firms to undergo a review aimed at ensuring the deal would not hurt U.S. food security.

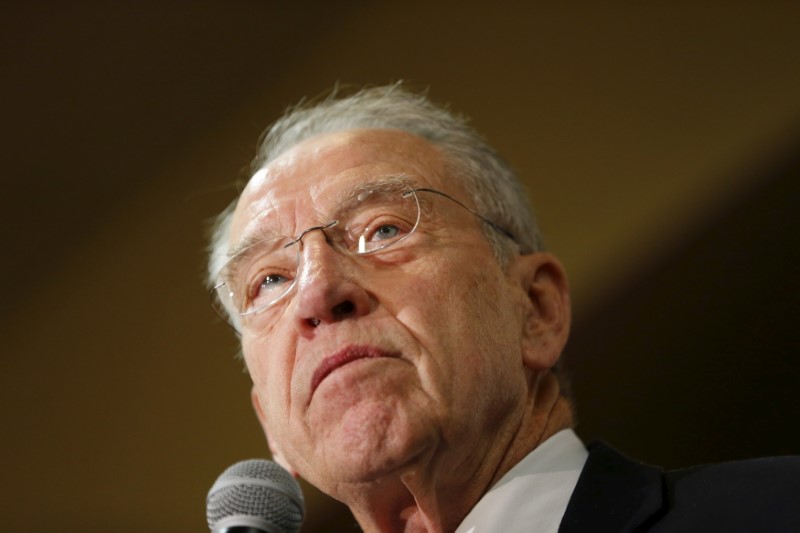

The legislation from Senators Chuck Grassley, an Iowa Republican, and Debbie Stabenow, a Michigan Democrat, would add the secretaries of the Agriculture Department and Health and Human Services, which oversees the Food and Drug Administration, to a panel that reviews mergers and other deals to ensure that transactions do not harm national security.

The agencies would join a group that has traditionally focused on preventing sensitive high technology and military expertise from falling into the wrong hands.

The Committee on Foreign Investment in the United States, or CFIUS, as the panel is known, is headed by the Treasury Department and includes the departments of Defense, Justice, Homeland Security, Commerce, State and Energy.

The bill currently has no companion in the U.S. House of Representatives. Representative Robert Pittenger, a Republican from North Carolina, has proposed exploring the idea of putting the agriculture secretary and the head of the Food and Drug Administration on the CFIUS board.

Lawmakers have been concerned about several deals in the farm sector, and Stabenow was critical of the 2013 purchase of pork giant Smithfield Foods, Inc by China's Shuanghui International Holdings, Ltd.

Since the discovery of tainted baby formula in China in 2008, the country has been hit by a series of food safety scandals. Chinese officials uncovered as many as 500,000 food safety violations in the first nine months of 2016, an official told Reuters in December.

The CFIUS panel is so secretive it normally does not even comment after it makes a decision on a deal. It approves most transactions, but under former President Barack Obama, CFIUS stopped a series of Chinese acquisitions of high-end chip makers.

In December, Obama blocked Aixtron's 670 million euro ($717 million) sale to Fujian Grand Chip Investment Fund over national security concerns.

In January 2016, CFIUS stopped Philips from selling its U.S. lighting business to GO Scale Capital, made up of GSR Ventures, Oak Investment Partners, Asia Pacific Resource Development and Nanchang Industrial Group.