By Lisa Lambert

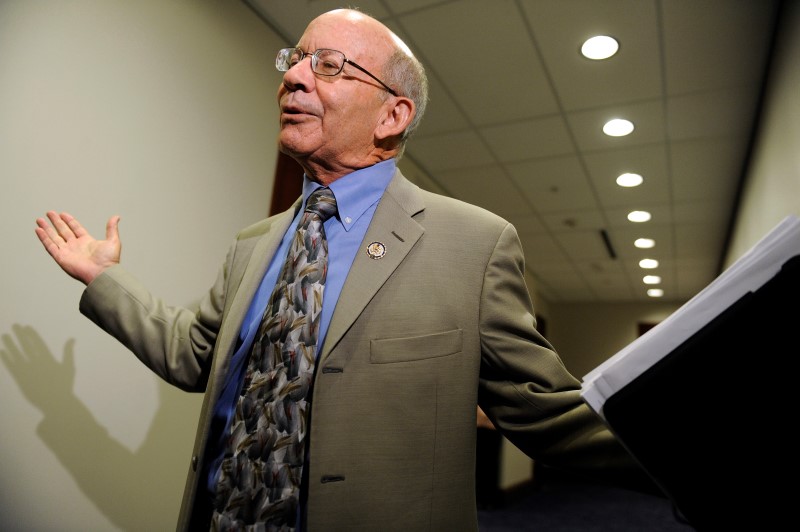

WASHINGTON (Reuters) - U.S. Representative Peter DeFazio on Wednesday unveiled legislation to tax financial trades that will likely wither in Congress but could stoke partisan fires in the presidential election.

The Oregon Democrat's bill would levy a 0.03 percent tax on most financial trades, and is intended to discourage "risky trading behaviors." DeFazio expects that will collect more than $417 billion in revenue in the next decade, which he said could be used to fund free higher education or infrastructure repairs.

When the Democratic Party gathers in Philadelphia for its national convention at the end of the month, it will adopt a platform that calls for taxing trades. Many liberals in the party embrace the proposal as a way to curb speculative trading, which they say led to both the 2007-09 financial crisis and the 2010 stock market "flash crash."

The party's left wing, led by U.S. Senator Bernie Sanders, who ran against Hillary Clinton for the presidential nomination, meanwhile, has pushed for free university education.

"Thanks to the reckless greed of Wall Street over the past few decades, the American economy is a grossly unbalanced playing field," said DeFazio.

"The only way we can level it is if we rein in reckless speculative financial trading and curb near-instantaneous high-volume trades that create instability in the stock market and our national economy."

The legislation is supported by Democratic Party stalwarts, including the AFL-CIO labor union federation, the Americans for Financial Reform coalition, the Center for Economic and Policy Research, the Communications Workers of America union, and advocacy group Public Citizen.

It will likely not get far. Republicans control both chambers of Congress, and most say that Wall Street regulation passed in the aftermath of the financial crisis has been overly restrictive. In addition, the Republican Party generally favors having fewer taxes.

"I am opposed to any taxes that would raise the cost of financial transactions,” said Randy Neugebauer, the Republican chairman of a House subcommittee on financial institutions, noting that the bill would tax stock, bond and derivatives trades.

Currently, the top U.S. securities regulator, the Securities and Exchange Commission, charges a tax on security futures of less than half of a penny to recover the costs of regulating markets and financial professionals.

The idea for the tax can be traced back to economist John Maynard Keynes, who wrote in 1935 after another devastating financial crisis - the Great Depression - that a transfer tax on all transactions might mitigate speculation.