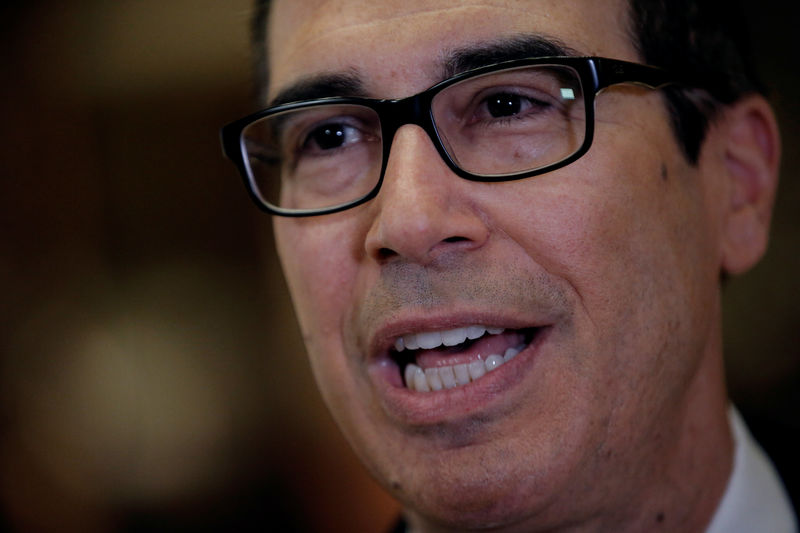

WASHINGTON (Reuters) - Comprehensive reform of the U.S. tax code is still likely to pass by the end of 2017 despite the government spending deal President Donald Trump struck with Democrats, U.S. Treasury Secretary Steven Mnuchin said on Thursday.

In an interview with Fox Business Network, Mnuchin said he was not worried about the plan going off track because of either Democrats, who won the surprise deal on Wednesday with the Republican president, or more conservative Republicans making their own demands.

"It's still very viable to get it done this year," Mnuchin said. "We have a path to get this done this year, and we're still very hopeful that we can get it done," he added, saying it was his and Trump's top priority.

Asked whether he was concerned, however, that Democrats could use the funding deal struck Wednesday to make demands such as rejecting any tax cut for the wealthy or pushing for a cut for middle income earners, Mnuchin said no.

Instead, he said Wednesday's deal "cleared the decks 90 days to have more room to focus on taxes. I think that was a big win," adding that he expected some Democrats to back the final plan.

Separately, Axios reported that the Freedom Caucus, a more conservative faction of House Republicans, is planning to unveil their own tax plan that would cut the corporate tax rate from the current 35 percent to 16 percent.

It would also double the standard, abandon the idea of revenue neutrality and push some kind of welfare reform, Axios said, citing people familiar with the matter.

Asked about the report, Mnuchin told Fox Business Network: "I'm not worried about any GOP revolt at all," adding that lawmakers could push their ideas with leadership as part of a regular legislative process.

Mnuchin did not give any more details about the administration's tax proposal. On Wednesday, Trump said he would offer more details about his tax reform plan in about two weeks.