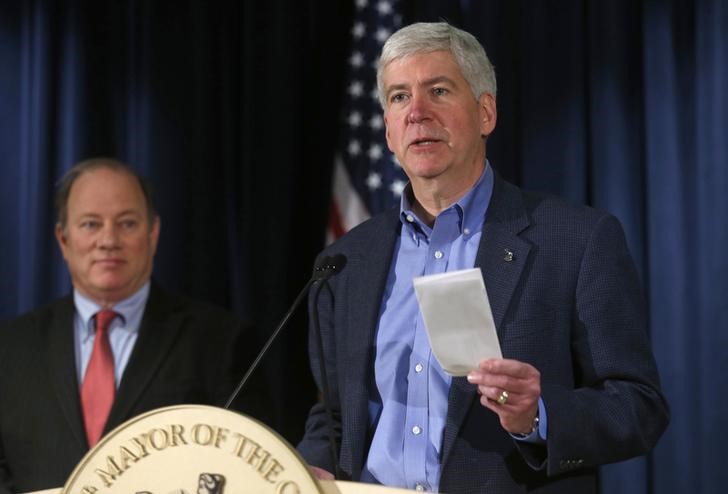

(Reuters) - Michigan Governor Rick Snyder on Wednesday signed into law a bill aimed at reducing interest rate costs for an upcoming Detroit bond sale.

Detroit privately placed $275 million of variable-rate bonds with Barclays (LONDON:BARC) Capital to finance its Dec. 10 exit from the biggest-ever municipal bankruptcy. As part of the city's U.S. Bankruptcy Court-approved plan, that debt is due to be sold in the U.S. municipal market in a fixed-rate mode by May 9. The deal will mark the city's first post-bankruptcy public bond sale.

"We need to ensure Detroit's debt is repaid under the terms of the bankruptcy to allow the city to continue its recovery," the Republican governor said in a statement. "The savings from lower interest costs will allow Detroit to reinvest in critical areas like public safety and municipal services."

The new law boosts security for the bonds by placing a specific statutory lien on Detroit income tax revenue pledged to pay off the debt. The move is expected to result in investment-grade ratings for the bonds, which in turn could save Detroit between $20 million and $30 million over the life of the issue, according to the governor's office.

There was no immediate comment from Detroit Mayor Mike Duggan's office on the status of the bond sale.

Proceeds from the bonds were earmarked for retiring a prior $120 million Barclays loan to the city, to pay certain creditor claims from the bankruptcy and to finance city improvements.