WASHINGTON (Reuters) - The Republican head of the tax-writing panel in the U.S. House of Representatives said on Friday progress was being made in efforts to allay concerns among some Republicans about the potential elimination of a federal deduction for state and local income taxes as part of a tax-reform push.

Some lawmakers from states where state and local taxes are high and people benefit most from the federal income tax deduction are reluctant to contemplate such an elimination. It would be one of several measures aimed at offsetting lost revenue under sweeping tax cuts planned by President Donald Trump and the Republican leadership in Congress.

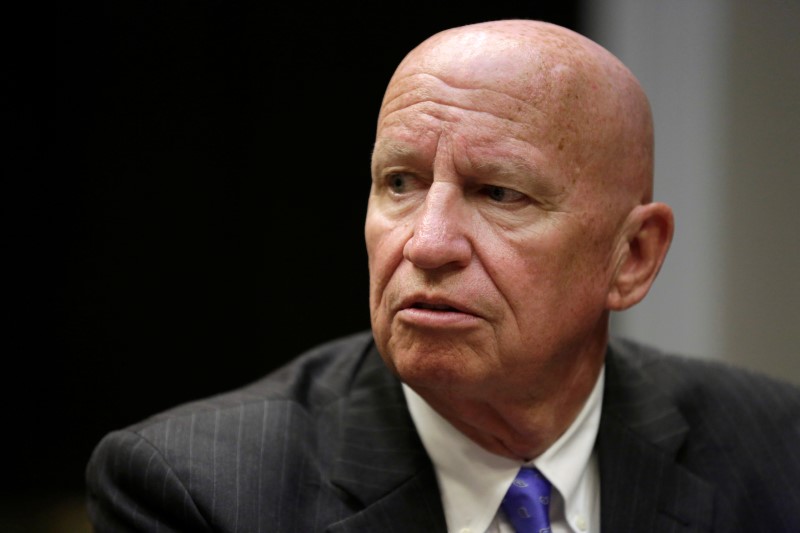

"We're working with these lawmakers. We are making progress, but we aren't there yet," House Ways and Means Committee Chairman Kevin Brady told Fox News Channel. "I'm hopeful at the end of the day we can find a good solution for them."

A budget blueprint central to Republican efforts to enact the tax cut package - because it will enable easier passage of the package through the Senate - barely squeaked through the House on Thursday, with Democrats solidly opposed and a number of Republicans voting no in an effort to protect the deduction.

Republican leaders had sketched out a tax cut plan that would eliminate the tax break, although detailed legislation will not be unveiled until next Wednesday.

Brady also said lawmakers were exchanging ideas with Trump over how to handle 401(k) retirement savings plans.

In another measure to offset lost revenue, House Republicans have considered eliminating or capping the ability to contribute to the plans on a pre-tax basis, but Trump has said he wants to protect the popular tax-deferred savings program.

"We want to increase the amount that you can give to your 401(k) or IRA (individual retirement account), for 401(k)s up to $20,000 or more," Brady told Fox, without specifying whether that would be on a pre-tax or after-tax basis.

"We're actually exchanging ideas with the president on how we help people save more and save sooner in their lives."

The current cap on pre-tax 401(k) contributions is $18,000 a year, and that is set to rise to $18,500 next year.