By Andrew Silver

SHANGHAI (Reuters) - As Novo Nordisk (NYSE:NVO) and Eli Lilly (NYSE:LLY) expand sales of their popular diabetes and weight-loss drugs, cheaper copies of their patented remedies are winning approval from some regulators overseas, posing a threat to the pharma giants' prices and market share.

Since Novo's blockbuster Ozempic diabetes treatment was approved in the United States in 2017, regulators have greenlighted 22 medicines containing its main ingredient in Bangladesh, Laos, Russia and Paraguay as well as seven copies of Lilly's rival drugs in Bangladesh, according to a Reuters review.

Ozempic's patented semaglutide ingredient is also used in Novo's wildly popular obesity treatment Wegovy and diabetes tablets Rybelsus, while Lilly's tirzepatide is used in Mounjaro and Zepbound.

This year, at least seven new products containing semaglutide have been approved for sale in Laos and Russia, according to public lists of licenced drugs, comments from a regulatory official, details of two approved medicines in Paraguay obtained via a freedom of information request, and information on the websites of two drug manufacturers.

Asked for efficacy data on the licenced analogue versions, regulators in Bangladesh, Paraguay and Russia did not respond. Davone Duangdany, director of the drug and medical device control division within the Laos health ministry, told Reuters that such information was confidential.

Regulators in Bangladesh, Laos and Russia did not immediately respond to Reuters' requests for comments on the rigor of their systems to approve, develop, manufacture and distribute drugs.

"What I can tell you on behalf of the institution is that the highest and most demanding standards have been taken into account for (the two Paraguay medicines) approval, as we would do for any other product," Jorge Lliou, head of Paraguay's National Directorate of Health Surveillance, told Reuters in response to a query about the origin of the active ingredient in the locally approved drugs.

The growing number of licenced copies could depress prices for anti-obesity medicines and risk a spillover effect into important markets such as India, where Novo's Rybelsus has already been launched, three pharma experts said.

Anna Kemp-Casey, a medical policy specialist at the University of South Australia, said prices for Novo's and Lilly's weight-loss drugs would initially remain supported as strong demand currently far outstrips supplies.

But "in the longer term it is likely that all this competition will put downward price pressure" on Lilly and Novo in India and other countries, she added.

Both drugmakers are racing to increase manufacturing capacity to meet unprecedented demand. More than a billion people globally are considered obese, a condition linked to various significant health complications. BMO Capital Markets has estimated annual weight-loss drug sales reaching $150 billion by 2033.

The proliferation of copies could ultimately undermine revenue for Lilly and Novo, whose shares have soared on robust demand for new weight-loss tablets and injector pens containing substances that mimic the activity of a hormone that slows digestion and helps people feel full for longer.

The Reuters review focused on countries where there is no Novo patent on semaglutide, that enjoy patent exemptions from World Trade Organisation (WTO) rules due to their status of developing economies, or where, like in Russia, there are local decrees that override such international regulations.

"The approval of generics by less-stringent regulatory agencies provides a legal framework for local manufacturers to produce these drugs for both domestic use and export," said Enrique Seoane-Vazquez, a pharmaceutical policy specialist at Chapman University in California.

Ozempic, which was developed to fight diabetes but reached global popularity thanks to its weight-loss side effect, has become a significant revenue driver for Novo, with sales reaching 95.7 billion Danish crowns ($13.5 billion) in 2023. Sales of Lilly's Mounjaro reached $5.1 billion last year.

Asked about the copies identified by Reuters, Eli Lilly said tirzepatide was a complex macromolecule that required rigorous testing.

"Any policies for approval of biosimilar products...present significant patient safety concerns. Regulators should proceed carefully, with patient safety at the forefront," Lilly said in a written statement.

Approached by Reuters, a spokeswoman for Novo declined to comment on potential risks of price competition from copies from Bangladesh, Laos, Russia and Paraguay.

Asked whether Novo was planning to apply for a patent in Paraguay, which does not enjoy an exemption because it does not meet the WTO criteria, the spokeswoman said the Danish company does not seek patent protection in every country worldwide.

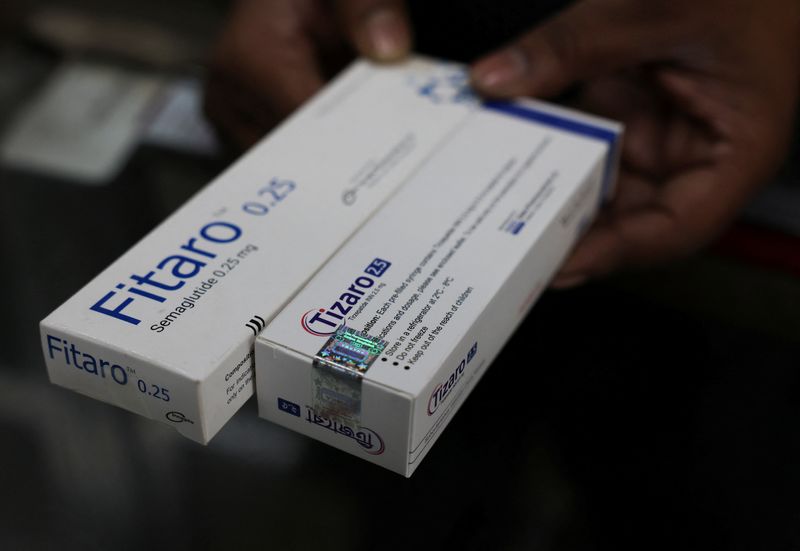

Reuters has earlier reported that two copies of Novo's weight-loss and diabetes drugs, Orsema and Fitaro, had been approved in Bangladesh. Some of the injector pens were seized at the border in a wealthier country where Ozempic's patent is protected, the UK, the same report showed.

Novo's patent on semaglutide expires in 2031 in Japan and Europe and in 2032 in the United States, but as early as 2026 in China and India, according to the company's latest annual report and industry experts. Lilly said in its annual report its tirzepatide patent runs out in 2036 in the United States, and later in other major economies.

RACE TO THE BOTTOM

The approved copies identified by the Reuters review tend to be much cheaper than the originals.

In Russia, for example, a month's supply of Semavic, used for diabetes and containing semaglutide, costs 4,420.20 Russian rubles ($42.76), according to local manufacturer Geropharm. That was 24% lower than the cost of a month's supply of Ozempic in Russia, Geropharm told Reuters.

In Bangladesh, a pack of Incepta Pharmaceutical (TADAWUL:2070)'s Orsema is priced at 350 or 600 Bangladesh taka ($3 or $5), according to local online medicine information directory Medex.

In the United States, however, a month's supply of Ozempic had a U.S. list price of $935.77 in September, while the weekly injection costs around $100 for each 3mL dose through China's public hospital network.

Novo has not launched Ozempic, Wegovy, and Rybelsus in Bangladesh, a Novo spokesperson told Reuters.

Due to its affordability, Semavic is appealing to potential customers abroad.

"We have noticed increased interest in the medication not only in Russia but also from foreign partners and colleagues, with inquiries ranging from (a group of former Soviet republics) to Latin America," Geropharm said in response to Reuters queries about overseas exports of Semavic.

Chirantan Chatterjee, an economist at the University of Sussex in Britain, said the growing significance of the obesity problem may also spur regulators in parts of Asia to ask Big Pharma to lower prices.

"The direction of travel is therefore more competition, lower prices, enhanced choices, and consumer welfare expansion in this area," Chatterjee said.

($1 = 7.0952 Danish crowns) (This story has been refiled to fix a typo in the headline)